In September 2024, the FDIC proposed a rule to improve recordkeeping for custodial (also called FBO, or “for benefit of”) accounts, where fintechs and non-bank entities pool customer funds in FDIC-insured banks. The goal is to ensure that banks can accurately identify individual fund owners and their balances, even when intermediaries track transactions.

The rule, aimed at enhancing depositor protection and increasing public confidence in insured deposits, could become law any day. When it happens, unprepared banks will have to scramble to put new technology and workflows in place to maintain compliance.

The catalyst: the 2024 Synapse bankruptcy

The proposed FBO rule is largely a response to the 2024 bankruptcy of Synapse Financial Technologies, a middleware provider that allowed businesses to integrate banking services into their own applications.

After a subsidiary of Synapse began offering cash management accounts to their partners’ end users, the company filed for bankruptcy protection. One of their partner banks, Evolve, froze access to Synapse accounts to the tune of over $200 million, stating lack of access to an essential system of record.

The result was chaotic. End customers couldn’t access their funds, but to release them the FDIC needed transaction and ledger records from Synapse. Between access issues and inadequate recordkeeping, there was no way to recoup losses using FDIC insurance. With $96 million missing and over 100,000 customers affected, the saga still isn’t fully resolved.

What are custodial, or FBO, accounts?

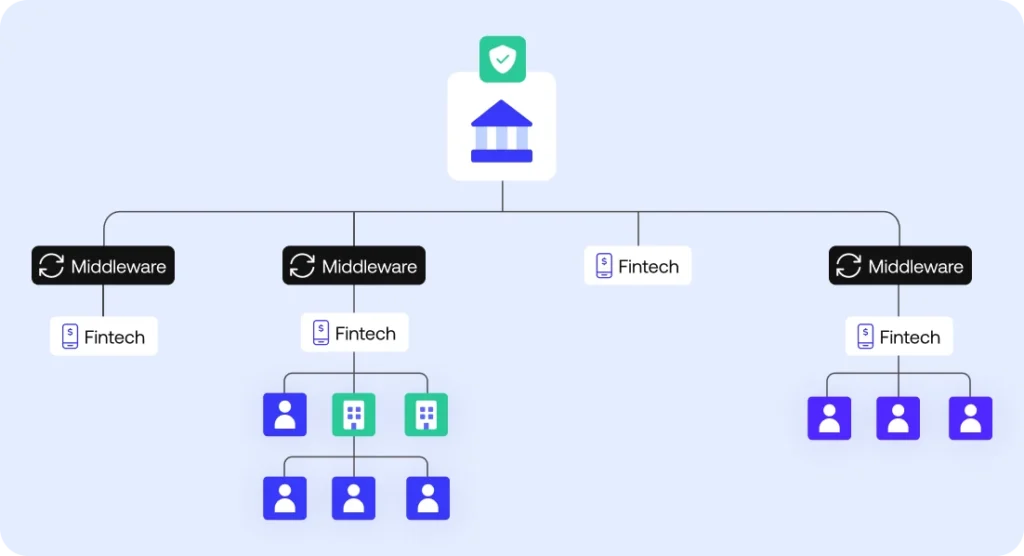

Custodial accounts are bank accounts held by one party (the “custodian”) on behalf of another (the “beneficial owner”). In fintech-bank partnerships, these accounts typically hold pooled customer funds under the fintech’s name or a third party’s, with individual user balances tracked outside of the core banking system by the third party.

This arrangement creates a visibility gap for the bank. It doesn’t inherently know who the end users are or how much each is owed, making things complicated for FDIC insurance determinations when something goes awry.

Why is custodial account recordkeeping so complicated?

Over the past decade, a huge influx of fintech companies have entered the market. These entities aren’t allowed to provide the full spectrum of financial products, so they rely on partners to enable them.

In the case of custodial accounts, these partners are banks (referred to in the rule as Insured Depository Institutions, or IDIs) who already are licensed and insured to provide accounts insured by the FDIC.

These partnerships create a complex ecosystem of intermediaries and fintech partners that each enable their own customer base to open accounts with the custodian bank. For most banks, it’s nearly impossible to keep track of who manages whose accounts, transaction details, and daily balances across all of the different systems.

For example, while individual customers may initiate millions of transactions each day on the fintech side, the details aren’t necessarily preserved by various members in the ecosystem. Some will initiate bulk movements that aggregate individual transactions into a single amount, making them hard to disambiguate later.

Any company growth, new partnerships, or regulatory changes just increase this complexity, risking the loss of visibility and traceability of critical financial movements. Catastrophic events like the Synapse bankruptcy don’t happen every month—but losing millions to leakage, inefficient operations, and audit fees is far more common.

What are the FDIC’s proposed changes to FBO accounts?

The FDIC’s proposed rule, Part 375, outlines new requirements for maintaining and reconciling records for FBO accounts. IDIs holding custodial deposit accounts with transactional features would be required to:

- Meet new recordkeeping requirements, including maintaining records of custodial account details like the beneficiary, owner, and the balance attributed to each end user in a standardized format.

- Be subject to an annual validation by an independent person or entity to assess and verify that third parties are maintaining accurate and complete records consistent with the proposal’s requirements.

- Implement internal controls to ensure that balances of custodial deposit accounts are accurate and reconciled daily.

- Complete an annual certification of compliance and an annual report of compliance.

Banks would be allowed to partner with a trusted third-party to meet these requirements, as long as certain conditions are satisfied. They must have direct, continuous, and unrestricted access to the records maintained by the third party, as well as have continuity plans and internal controls in place.

How do the FDIC’s proposed changes affect PSPs and fintechs?

For banks to meet these requirements, their fintech and intermediary partners must be able to provide daily transaction-level data on money moving to and from custodial accounts. These individual records must be reconciled against FBO balances, taking into account complications like rolling reserves and delayed settlements.

To facilitate this, PSPs and other fintechs should invest in scalable, real-time transaction tracking and reconciliation technology that can sync data across all systems at least once per day.

How Simetrik helps you prepare for the new FDIC rule

Simetrik is an enterprise reconciliation platform that helps banks maintain and govern this improved method of recordkeeping that will soon be required by the FDIC.

Here’s how it works:

- Banks can integrate data from all of their fintech and middleware providers in one place, standardizing it to meet the specific requirements outlined in the proposed rule.

- Transactions are monitored and reconciled daily, catching discrepancies and potential fraud instantly so they can be handled before reporting to the FDIC.

- Bulk money in/money out records are automatically disambiguated to keep end user balances accurate.

- Simetrik dashboards inform stakeholders of individual beneficiary activity and balances, total daily net movement, daily cumulative balances, and more.

- Simetrik users can search and explore a subset of custodial accounts, like a specific partner.

- Reporting is automatically prepared for appropriate third-party auditors and shared in the correct format.

A similar process applies to fintech and middleware providers who choose to follow suit by adopting Simetrik. Transaction data from their platforms is monitored and reconciled daily with bank balances. This reconciled data is always accurate, searchable, and ready to use in customer-facing products or to meet additional reporting requirements.

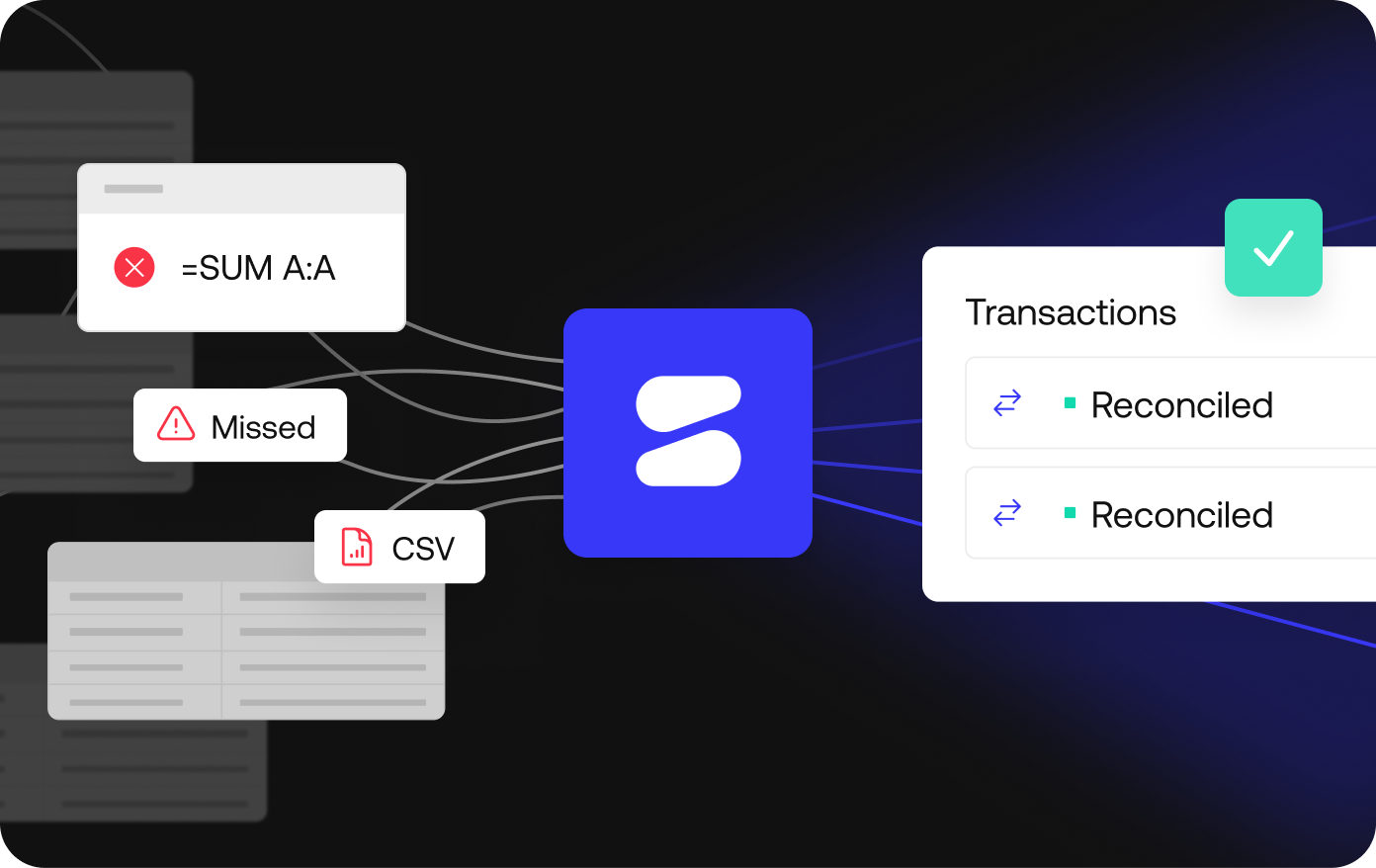

Scaling with no code automation

Unlike legacy or homegrown solutions you may have used in the past, Simetrik doesn’t require expensive integrations or hours of engineering work to set up each partner. Unify your custodial account transaction data and configure advanced reconciliation logic faster with flexible, no-code building blocks—so you’ll be ready when the proposed rule becomes enacted law.

Don’t get caught unprepared

The FDIC hasn’t yet announced when this rule will go into effect, but it may happen soon. While you still have time, adopt a unified reconciliation platform that will make the whole process painless and successful.