Acquirers play a pivotal role in the modern financial ecosystem, facilitating card payments and disbursing the right amount to merchants with every purchase. But each transaction is a potential point of failure that’s subject to risk from errors, disputes, and revenue leakage.

To handle high transaction volumes and maintain your reputation in a fragmented payments market, you must reliably automate reconciliation and reporting—starting with activity related to the card networks that make up a major portion of your transactions.

Simetrik’s preconfigured Visa and Mastercard solutions make this possible without exorbitant costs or a heavy engineering lift. It’s designed to help you set up best-practice reconciliation workflows with no code, guided by an intelligent setup assistant and a dedicated onboarding team, and maintain full visibility into the inner workings of your rulesets and logic as they evolve.

We’ve connected nuanced capabilities and financial controls to enable six key use cases, from authorization to dispute management, in a way that’s easy to deploy and adopt.

Why should acquirers automate reconciliation?

Monitoring and reconciling card network transactions is critical to your success as an acquirer. Visa and Mastercard not only make up a large portion of total transactions, they also each have their own set of requirements for acquirers, including specific audit frameworks and scheme fees that must be tracked meticulously.

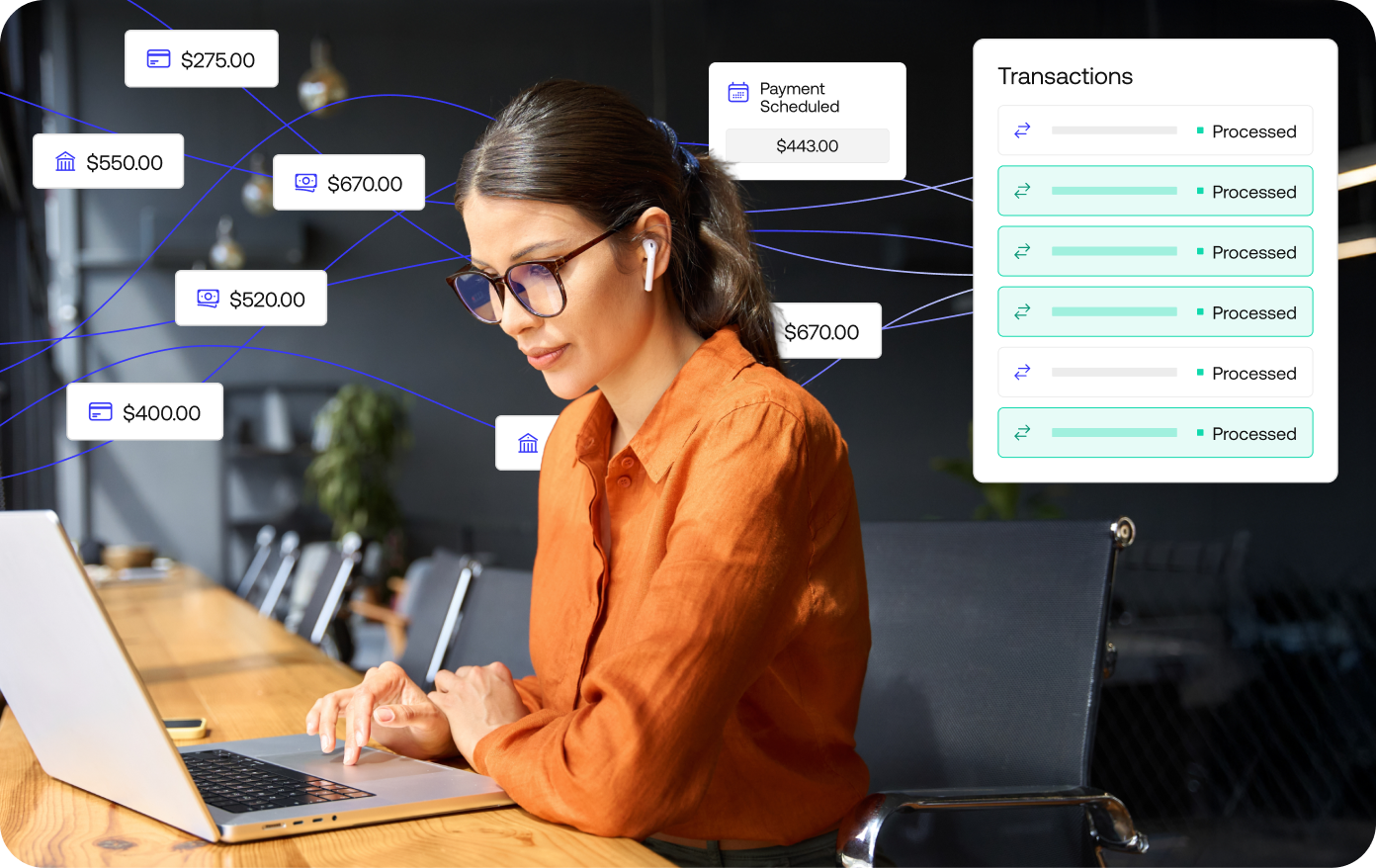

Simetrik automates reconciliation down to the transaction level, matching records across internal and external systems and generating reports for your merchants, auditors, and other stakeholders that are already aligned with Visa and Mastercard’s requirements. Instead of managing spreadsheets and scrambling to organize data for network reports like the QMR (Mastercard Quarterly Member Report) and GOC (Visa Global Operating Certificate), you can focus on quickly remediating errors and disputes.

Once data is reconciled and verified, it can be used by your team and your merchants to make better operational decisions, from forecasting to fee strategies.

5 reasons to automate Visa and Mastercard reconciliation:

- Improved cash-flow visibility

- Accurate forecasting

- Efficient fee management

- Faster dispute resolution

- Stronger risk management

6 key functionalities you can enable on Simetrik

Simetrik connects acquirer-supplied scheme files, bank statements, and records from internal systems like your ERP, automating six key reconciliation use cases for Visa and Mastercard transactions:

- Funding – Validate programmed versus received bank receipts, investigating partials or delays to ensure compliance and timely execution.

- Authorization – Ensure control and reduce fraud by reconciling authorized requests and responses with network data and matching clearing files to issuer records.

- Clearing – Validate scheme fees, interchange fees, and network adjustments against acquirer records to prevent overbilling and missed charges.

- Disputes – Confirm funds debited from issuers, reconcile pre-arbitration and arbitration cases, and help merchants manage evidence.

- Settlement – Calculate daily net settlement and validate receipts against bank statements for optimal liquidity management.

- Agenda – Split domestic and international agendas, with or without deferment, validating expected financial movements to prevent loss from delayed or missing settlements.

Minimize risk with fast, guided deployment

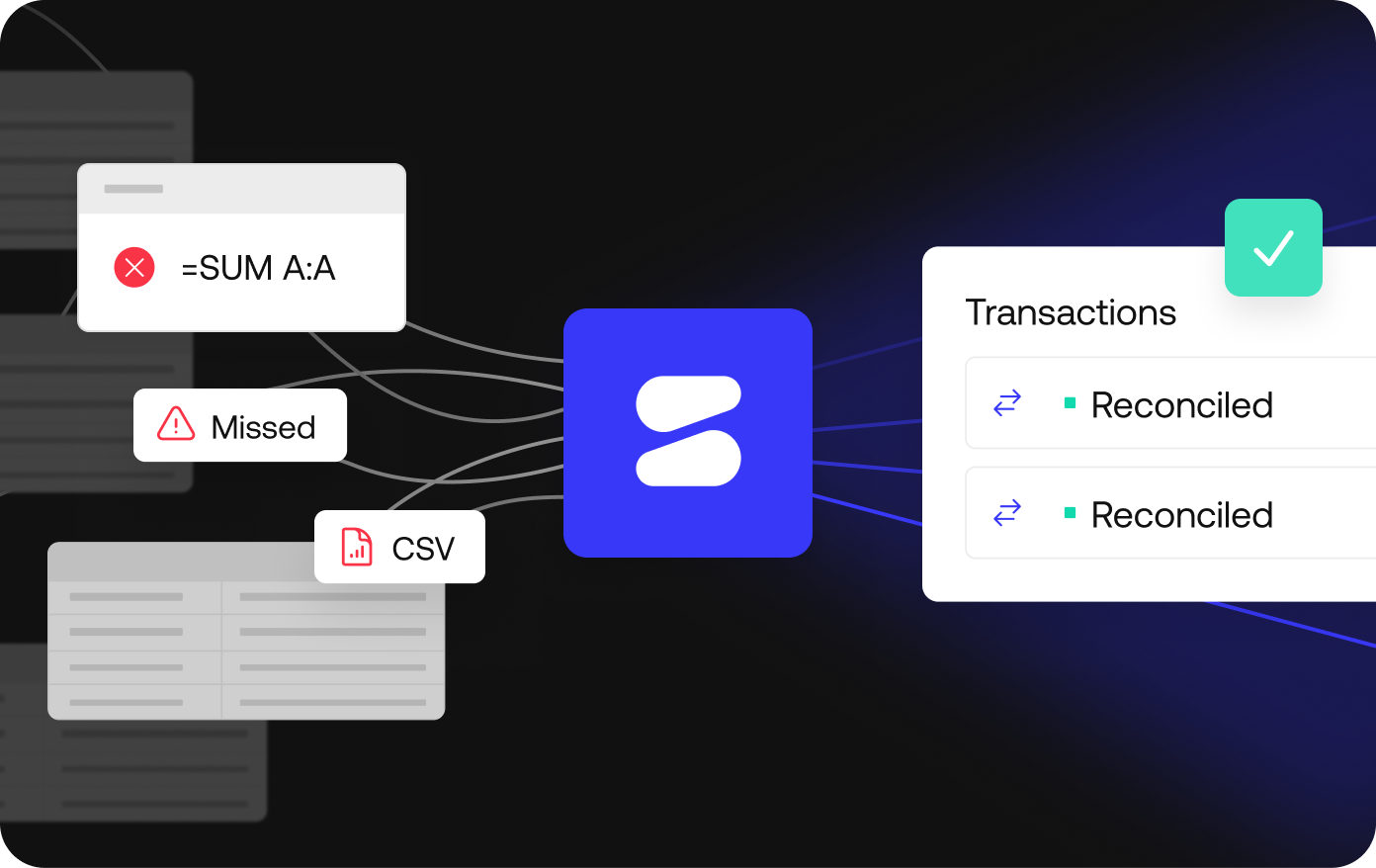

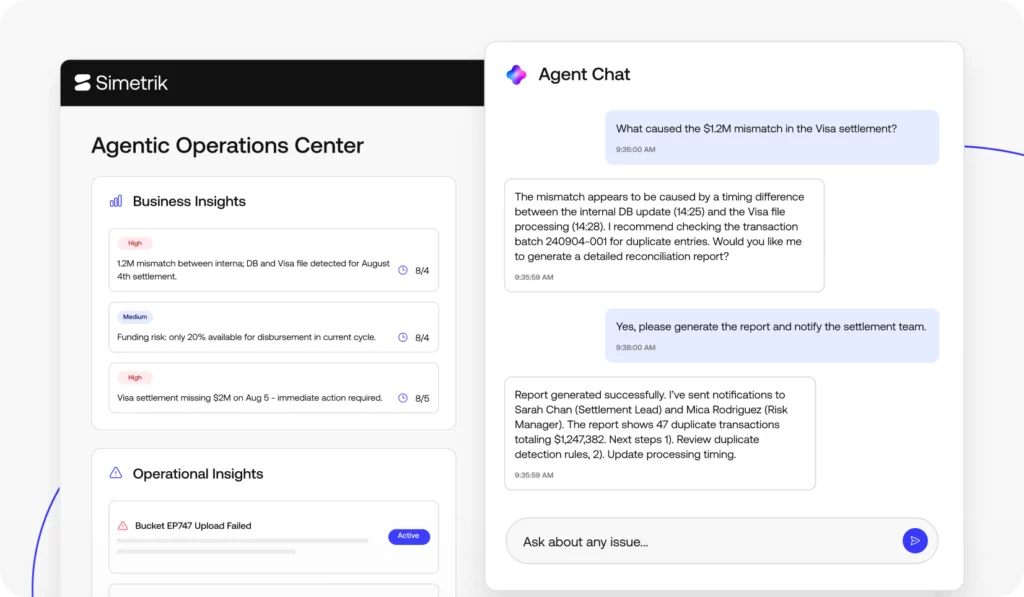

Simetrik leverages a dedicated onboarding team alongside AI-enhanced setup flows to help you quickly improve reconciliation and reporting. The platform eliminates careless errors while giving users control over the final output, complete with built-in governance and guardrails that maintain the integrity of your data.

With Simetrik, you don’t have to worry about managing a tough implementation alone. Our Visa and Mastercard solutions can be delivered in weeks, not months, with help from a dedicated onboarding team and an intelligent, guided setup assistant.

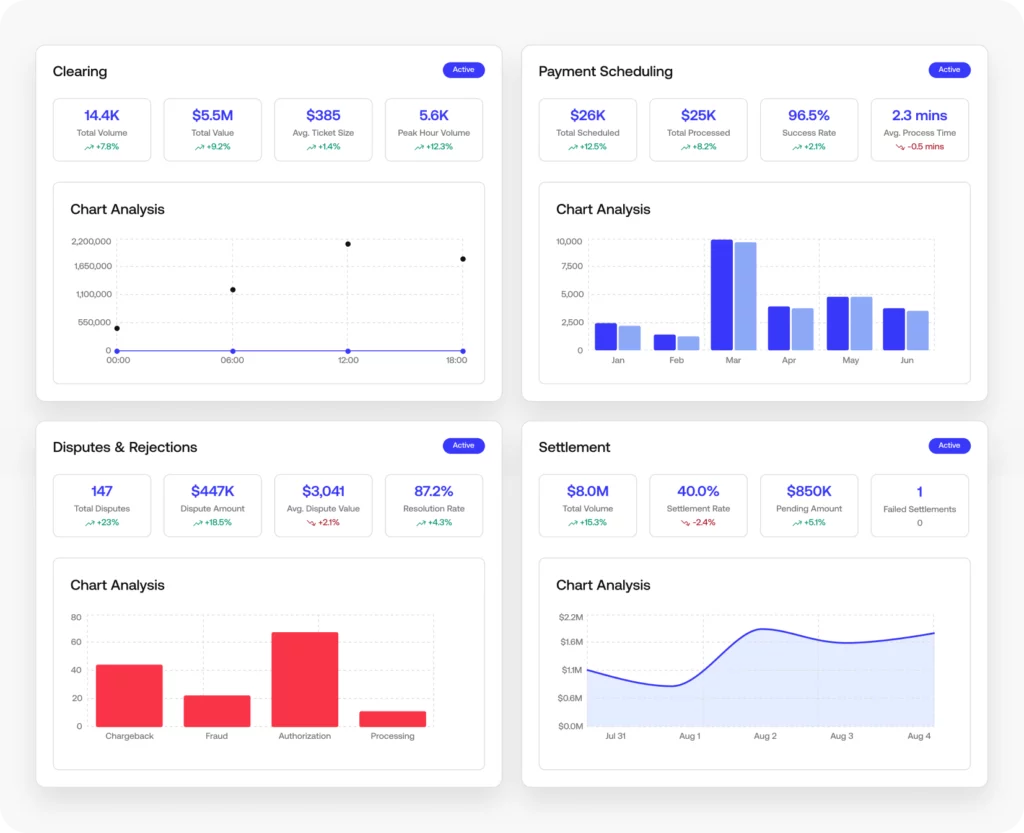

Simetirk customers can also choose from prebuilt, customizable dashboards that highlight the metrics acquirers care about the most—out-of-the-box KPIs with drill-down capability and AI-driven recommendations.

Get started with a personalized demo

Want to see Simetrik’s card network solutions in action with your own data? Get in touch to request a demo and we’ll show you how to scale reconciliation with modular, ready-made workflows.

Learn more about our Visa and Mastercard solutions.