Back in 2024, we landed our Series B led by Growth Equity at Goldman Sachs Alternatives. It was an exciting time even then, but we didn’t know what was coming. Since then, we’ve raised a Series B1, witnessed a rapid shift in the financial ecosystem, and watched the AI boom transform the world of software forever.

Today we’re thrilled to announce an additional $30 million investment, with Goldman leading once again. This financing brings our Series B to $85 million, accelerating Simetrik’s expansion into the United States and other new high-volume, highly regulated markets.

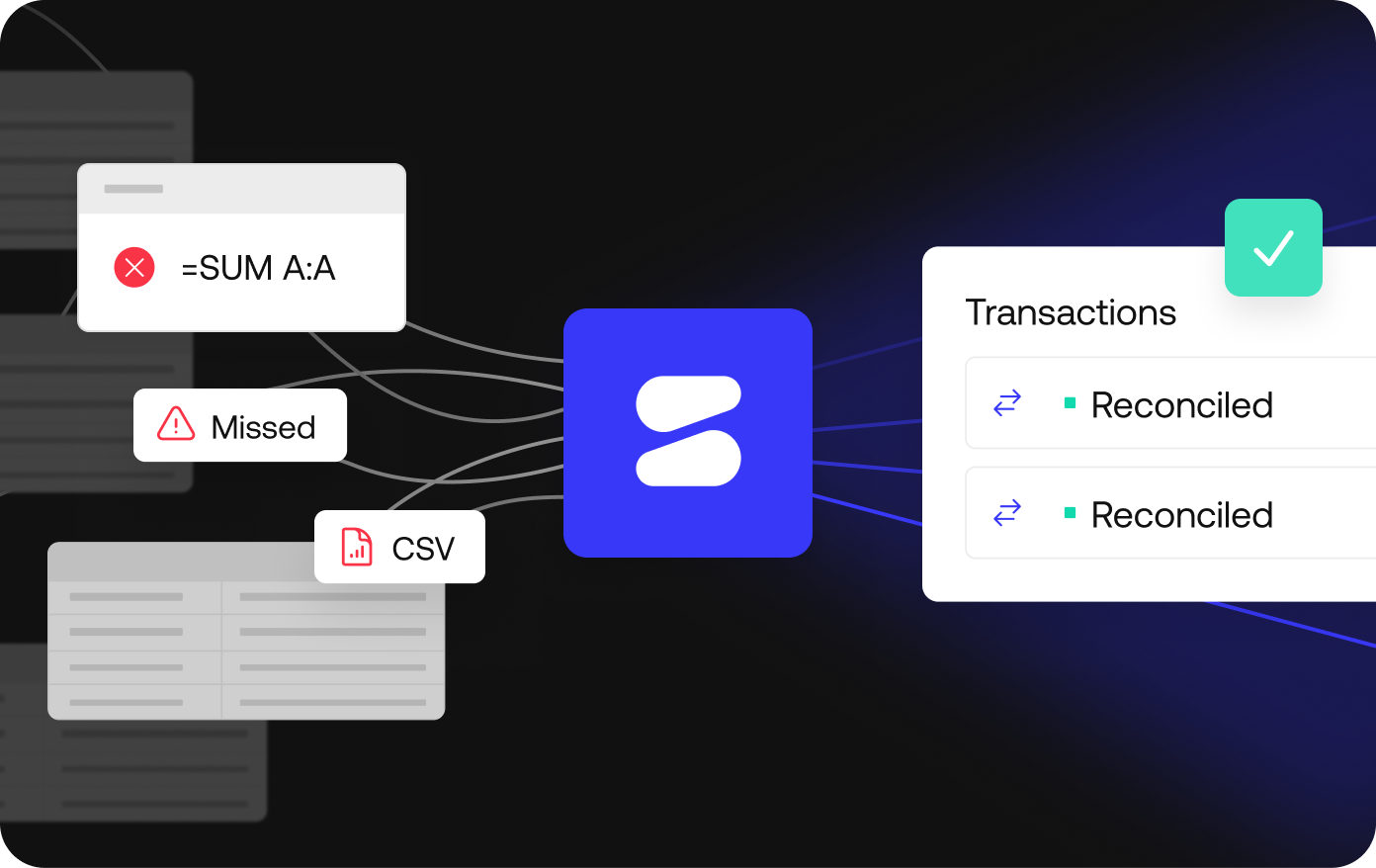

Reconciliation today is an outdated function that plagues even the best teams with wasteful manual work and margin-eroding technology costs. Until now, it has been impossible to process and reconcile enterprise transaction volumes at any scale, leaving significant visibility gaps and exposing financial operations to substantial risk.

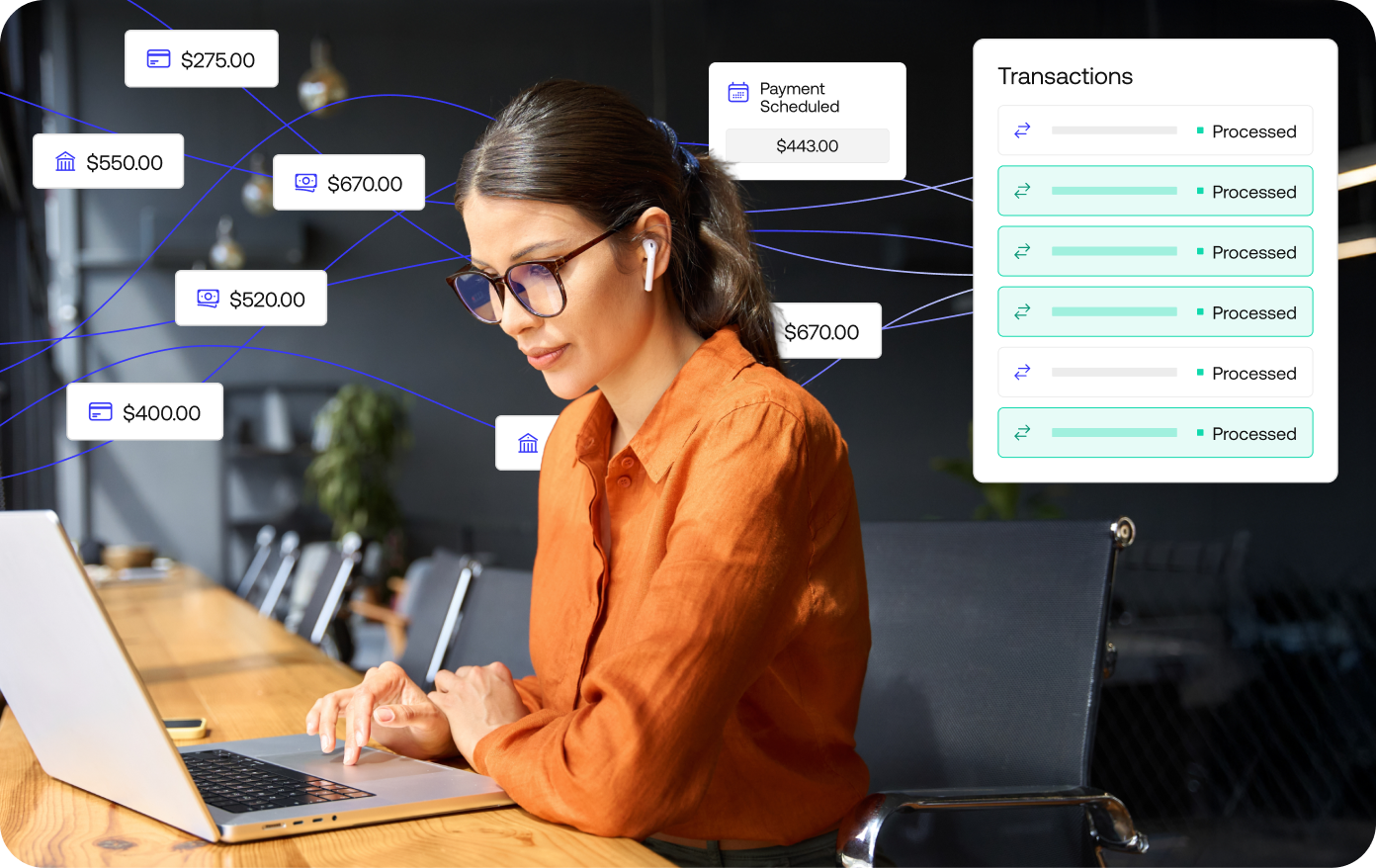

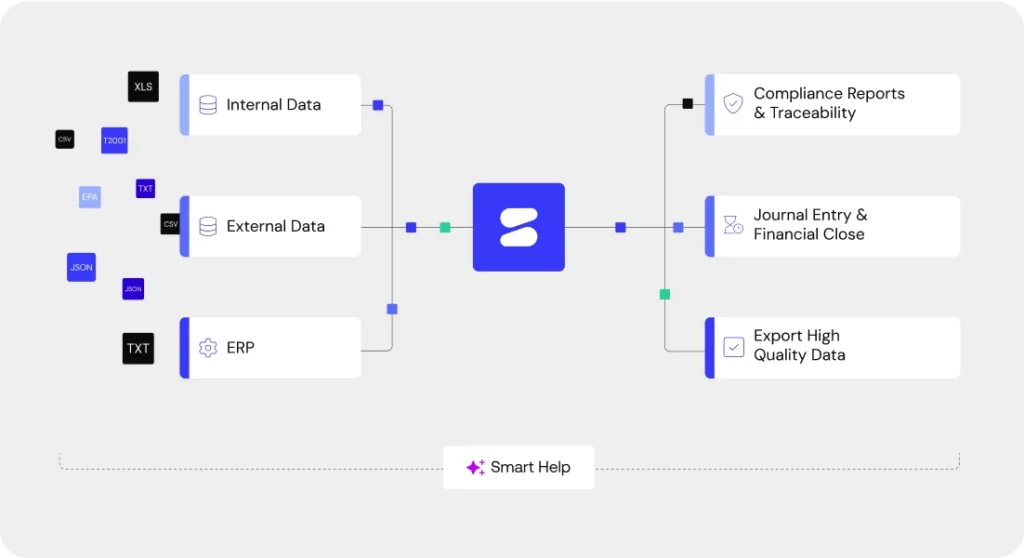

Simetrik is an AI reconciliation platform that automates transaction matching, mitigates risk, and ensures compliance at enterprise scale. We simplify complex financial operations for our customers, with reconciliation at the heart of everything we do.

By applying agentic AI and no-code automation to reconciliation, exception management, and compliance workflows, we help companies achieve new levels of financial oversight and efficiency at every level. The platform now processes more than one billion records per day in 40+ countries, automatically reconciling multi-way transaction data and then aligning it with journal entries and operational balances.

“Fragmented systems, skyrocketing volumes, and shifting regulations are pushing traditional reconciliation to a breaking point.”

Santiago Gómez, Simetrik’s co-founder and COO.

“We give FinOps teams the automated workflows and controls they need to stop making costly errors, shorten the monthly close by days, and export AI-ready data for forecasting, risk modeling, and product innovation. All without writing a single line of code.”

For companies subject to multiple nuanced regulations and internal audits, this approach to automation has powerful downstream effects. Reconciled data is reported accurately down to the transaction level, simplifying audits and alerting the finance team to exceptions in real-time. Simetrik customers automate 100% of their reconciliation workflows, strengthen margins, and open up new paths to innovation in an increasingly complex international payments environment.

“Goldman Sachs’ continued support validates the global demand for a purpose-built AI reconciliation platform.”

“With this investment, we’ll scale our US presence and deliver even faster time-to-value, helping finance teams cut waste, act immediately on discrepancies, and turn reconciled data into a strategic advantage.”

Alejandro Casas, co-founder and CEO of Simetrik.

Simetrik’s customers include Stax Payments, Santander Group, Sephora, Possible Finance, Mercado Libre, Oxxo, Rappi, PayU, PagBank, Falabella, Itaú, and Nubank, among others, and strategic partners such as Deloitte. This trusted base has fueled the company’s 100% year-over-year revenue growth and rapid international footprint.