By 2029, global payment revenues are expected to reach $2.4 trillion. That’s an increase of over 25% from today’s figures, spread across a fragmented landscape of banks, card schemes, clearinghouses, payment processors, and other payments stakeholders.

Real-time payment rails have added a new level of complexity and opportunity to the landscape. These relatively new networks make it possible to move money instantly from party to party, regardless of currency, region, or protocol. Payments service providers (PSPs) are embracing instant payments to stay competitive, but the move doesn’t come without risk.

As customers demand more immediacy and convenience, PSPs must closely examine their technology investments and financial partners to optimize the benefits of real-time payments. As you plan for scale at your own organization, make reducing complexity a top priority for your finance team.

The growing complexity of instant payments

Real-time payments haven’t been around for long, but they’ve transformed the industry. The Unified Payments Interface (UPI) in India was launched in 2016, the US-based Clearing House’s RTP Network launched in 2017, Brazil-based Pix went live in 2020, and alongside global counterparts in more than 70 countries they have already processed trillions of dollars in real-time transaction volume per year.

The impact of these rapidly adopted new payment rails is that PSPs can enable faster, more convenient ways for merchants to accept payments from their customers. From a user perspective it’s easy to make instant payments on these platforms, but behind the scenes there are many moving parts that often eat into margins and cause regulatory confusion.

Let’s dive into each of them.

The sponsor bank relationship: a delicate balancing act

Finding the right sponsor bank is key to your long-term success as a US PSP. To select the best partner, ensure agreements are structured to optimize outcomes on both sides.

First, consider which regions you operate in now or plan to in the future. Partnering with banks that have agreements in place with multiple RTP networks will make it easier to scale. Talk through how quickly you can enable payments via networks like the EU’s SEPA Instant Credit Transfer (SCT Inst), India’s UPI, and Singapore’s FAST, even if you’re not currently in those regions.

Next, examine the bank’s technology. Make sure they have robust infrastructure and integrations in place to support a large volume of real-time transactions on your platform without disruption. Ask about their adoption of shared standards like Swift GPI and ISO 20022 XML V9 to understand the reconciliation roadblocks you may encounter. Check for strong risk management and liquidity guardrails that keep money moving even if volumes spike unexpectedly.

Then discuss the bank’s available funding models, including the pros and cons of each and how much flexibility you’ll have to move among them. Banks and credit unions typically offer one or more of the following modes:

- Pre-funding agreements – PSPs deposit a certain amount at the sponsor bank as to cover transactions up to that balance. This is a simple, low-risk option for the bank but requires you to tie up a significant amount of working capital and may pause transactions if the account falls below its threshold. However, variations on these models offer more flexibility, like just-in-time top-ups or hybrid pre-funding/credit models that keep transactions moving if volumes surpass the agreed-up threshold.

- Intraday sweeps – The sponsor bank monitors RTP volume and sweeps funds from PSP accounts throughout the day. This option reduces the need for large prefunding deposits but requires constant reconciliation and clear visibility into liquidity to be effective. If you’re still using legacy finance systems or struggling to reconcile payments at the transaction level, this model might not be feasible.

- Credit lines – The sponsor bank extends credit to PSPs, funding RTP activity to a certain limit and interest rate. Batch settlements occur via ACH daily, weekly, or monthly, complicating the reconciliation process but freeing up significant capital for the PSP.

Selecting the right sponsor banks and funding models is important, but in reality even the best partnerships can’t solve all of the big-picture challenges around reconciliation, liquidity management, and revenue leakage in today’s instant payment ecosystem.

The reconciliation challenge

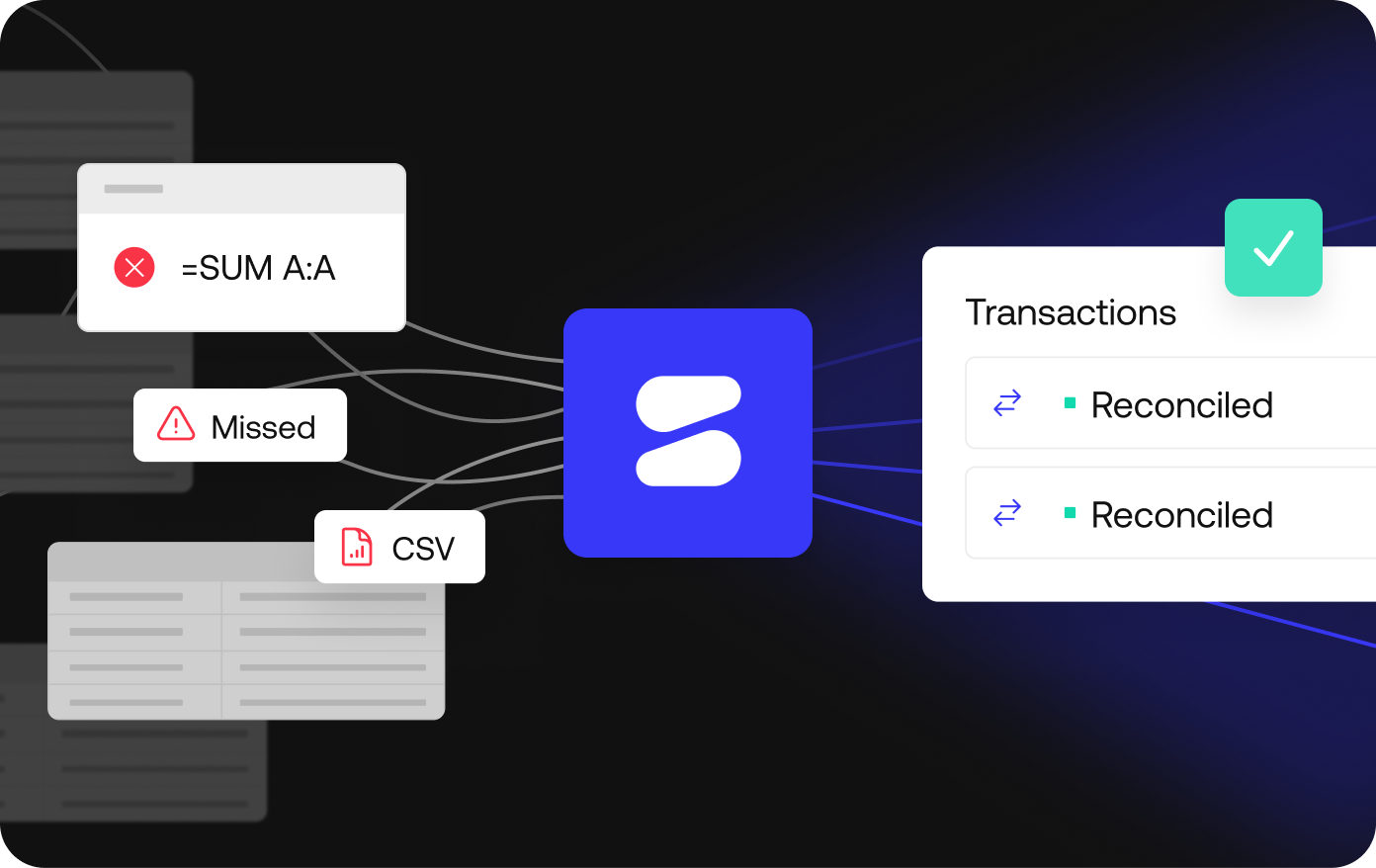

Reconciliation, or the process of validating and matching transactions to ensure financial integrity, becomes nearly impossible at the volume and complexity described above. The sheer number of partnerships, regulatory bodies, consortiums, and technologies needed to support instant payments across traditional and emerging systems calls for an entirely new approach to reconciling and managing transaction data.

Even at the enterprise level, many finance teams are still using spreadsheets and semi-manual processes to check each transaction against bulk settlements, fee deductions, and other activity along the payment journey. This gap between the ability to send and receive real-time payments vs. clearly tracking their business impact leads to major issues: revenue leakage, excess spending, and painfully drawn-out audits and close cycles.

To reconcile instant payments accurately and cost-effectively, PSPs must have a clear view of the entire RTP value chain in one place. But because these networks are fairly new and run by disparate government and hybrid public/private entities, there is still limited interoperability between them.

The effect of real-time payments on liquidity

PSPs that don’t address these challenges will find that instant payments hinder their liquidity and financial health. Lack of visibility at the transaction level leads to poor working capital management and blind decisions around financing, while losses due to reconciliation errors, fraud, and missed collections directly eat into available cash.

Paired with the right partners and technology, however, real-time payments boost your financial resilience and help you retain customers in a crowded market. Modern reconciliation platforms automate your finance team’s most error-prone, inefficient workflows, making it possible to process and reconcile millions of real-time transactions each day.

Reconciliation also makes it easier to optimize your agreements with sponsor banks. Keeping a healthy balance over the accounts connected to RTP rails is key for any pre-funding, sweeps, or hybrid model, and having full visibility into the details of past transactions helps predict future demand so you always have appropriate funding in place.

Once reconciliation isn’t a blocker, instant payments become a strength. Instead of worrying about a sudden lack of working capital, you can focus on providing cutting-edge services to your customers.

Simetrik: AI reconciliation for the instant payment era

Simetrik is a comprehensive transaction reconciliation platform that unifies data across every system involved in real-time payments, automates multi-way matching, and exposes exceptions before they become a problem.

PSPs rely on Simetrik to achieve new levels of scale and auditability across four distinct areas:

- Cost control and fee management – Expose, validate, and optimize all of the fees associated with RTP rails.

- Cash position and liquidity – Accelerate settlement, reduce working capital drag, and improve forecasting and visibility.

- Regulatory reporting – Reduce risk and automate reporting across SOX, PCI, GLBA, and other obligations.

- Cross-border and crypto transactions – Tame FX, network variance, and on/off-ramp complexity with reliable, scalable reconciliation.

By 2028, real-time payments will account for over a quarter of global electronic payments. To learn how Simetrik streamlines RTP complexity and turns this fast-evolving market into a strategic profit lever, request a demo of our platform.