When you think about resilient finance operations, what comes to mind?

Accurate numbers, limited risk exposure, data-driven decisions, and well-controlled costs—all of these are made possible through the process of reconciliation.

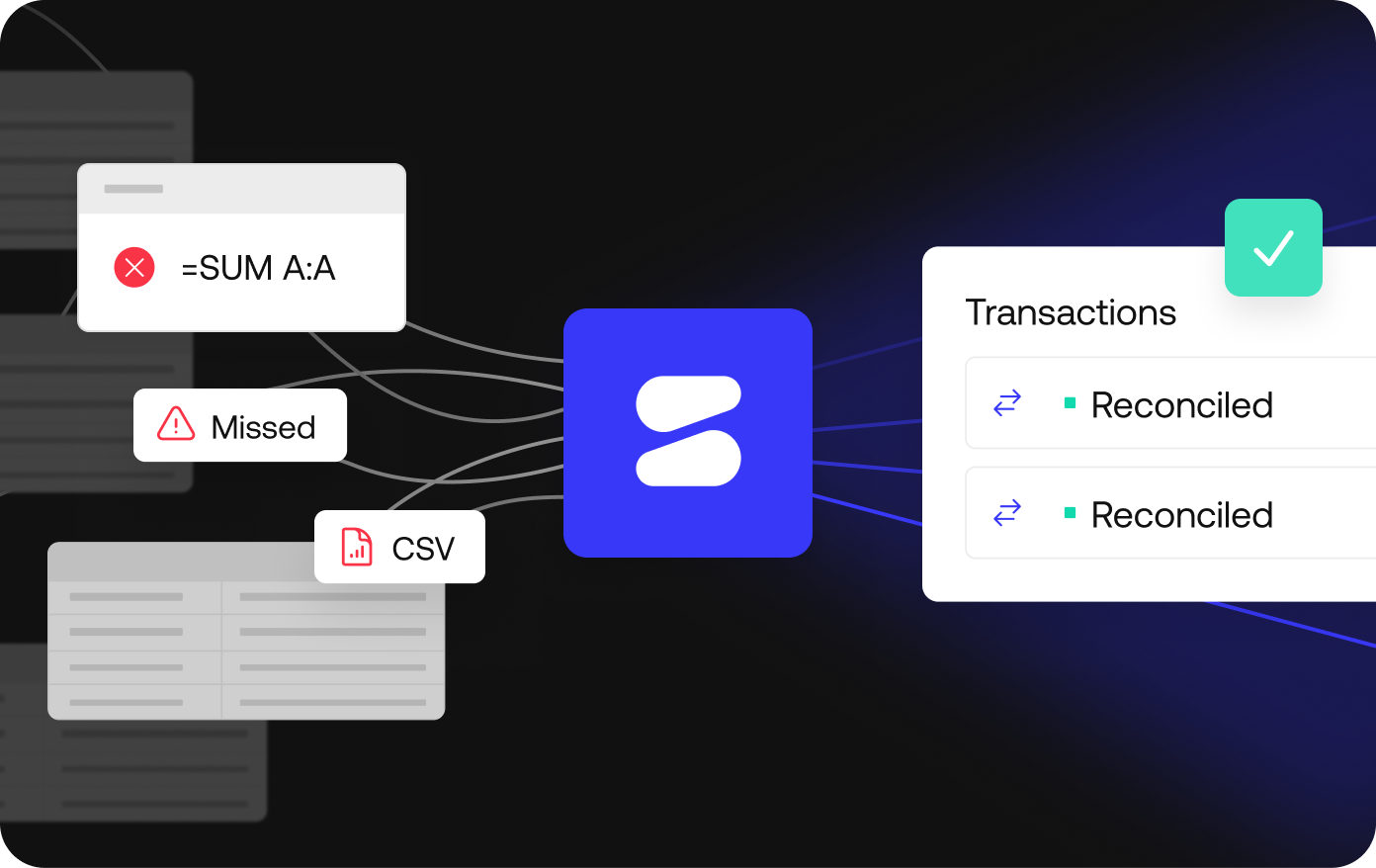

Today, however, the reconciliation process is still plagued by outdated technology and manual number-crunching. It’s tedious, rife with errors (as seen in recent public cases where mistakes have cost companies millions), and unscalable in a market where complexity seems to grow by the minute.

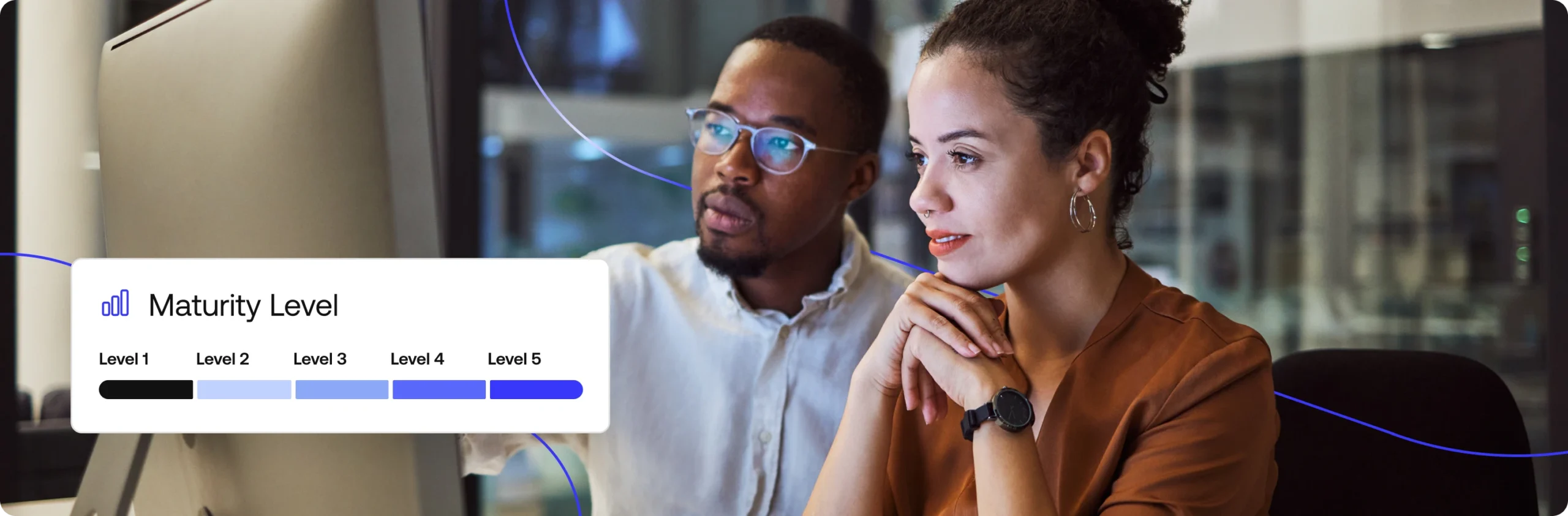

It’s time to adapt. In this guide, we’ll take a look at a model for reconciliation maturity that will guide you toward fully automated, AI-enabled reconciliation at every level. From siloed, costly operations to expertly orchestrated workflows with clear ROI, each advancement reduces cost and drives efficiency across the organization.

5 factors making reconciliation painful:

- Massive transaction volumes involving many fintech, payments, and banking partners

- Highly complex, nonstandardized remittance data in varied formats

- Stringent, inconsistent regulations across many regions and industries

- A fast-growing market that regularly requires new partnerships, integrations, and workflows

- The en masse adoption of AI that requires real-time, trusted data to operate

Why reconciliation maturity matters now

Until recently, the standard response to reconciliation complexity was to add headcount, boost engineering spend, or accept a baseline level of revenue leakage, audit fees, and costly errors.

But the modern financial ecosystem has reached an inflection point that makes this path impossible to stay on. The last decade has seen sweeping changes in global regulations, an explosion of payment companies and offerings, open banking standards, and an AI boom that reset the bar for real-time data access and deep interoperability.

Legacy reconciliation solutions can’t meet the demands of today’s market, always one step behind and far too unreliable for the speed and volume of modern money movement. and Miss out now, and you’ll face increasingly prohibitive costs as you try to keep up with competitors who’ve adopted scalable, AI-ready reconciliation platforms.

The great enabler: the AI reconciliation platform

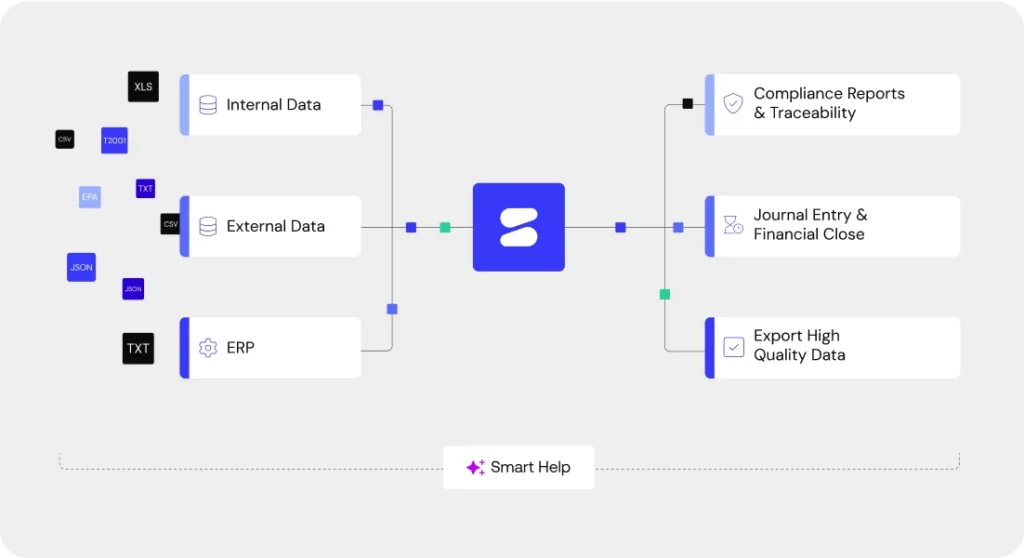

To reach full reconciliation maturity, companies need technology that can handle enterprise complexity. While it’s possible to make it past the first stage of reconciliation maturity using point solutions or home-grown scripts, you won’t get much further without a unified platform for all of your reconciliation data, controls, and workflows.

AI reconciliation platforms help you integrate internal and external transaction data sources, connect internal systems like your ERP or core banking system, and deploy sophisticated governance and automation in a way that doesn’t plunge you into technical debt as regulations and business needs change.

Get reconciliation right, and everything else falls into place.

The best reconciliation platforms do more than just reconcile multi-way transactions. They incorporate agentic AI and intelligent, adaptive rulesets to reconcile data at three distinct levels:

- Transaction level – Matching individual transactions to create a reliable source of truth for all downstream processes, detecting anomalies and discrepancies in real time.

- Financial level – Using reconciled data to manage cash flow and control costs, supporting strategic decisions, and reporting accurately to internal and external auditors.

- Accounting level – Aligning transaction and financial data with journal entries to ensure compliant, accurate reporting and accelerate close cycles.

In the next section, we’ll show you how adopting an AI reconciliation platform is essential to increasing the maturity of your finance operations. There are many paths to success—keep reading to explore ways to advance that fit your unique use case, resources, and goals.

What can an AI reconciliation platform do?

- Process massive transaction volumes with low latency at T+1 speed

- Standardize and match multi-platform, highly varied transaction data

- Meet stringent, inconsistent regulations across many regions and industries

- Keep TCO manageable with no-code, scalable deployment and iteration

- Support constant change and scale with zero downtime

An actionable model for reconciliation maturity

Fully mature, AI-optimized reconciliation drives value beyond just reporting the numbers. It gives you trusted, real-time financial data to use in any downstream application you can dream up.

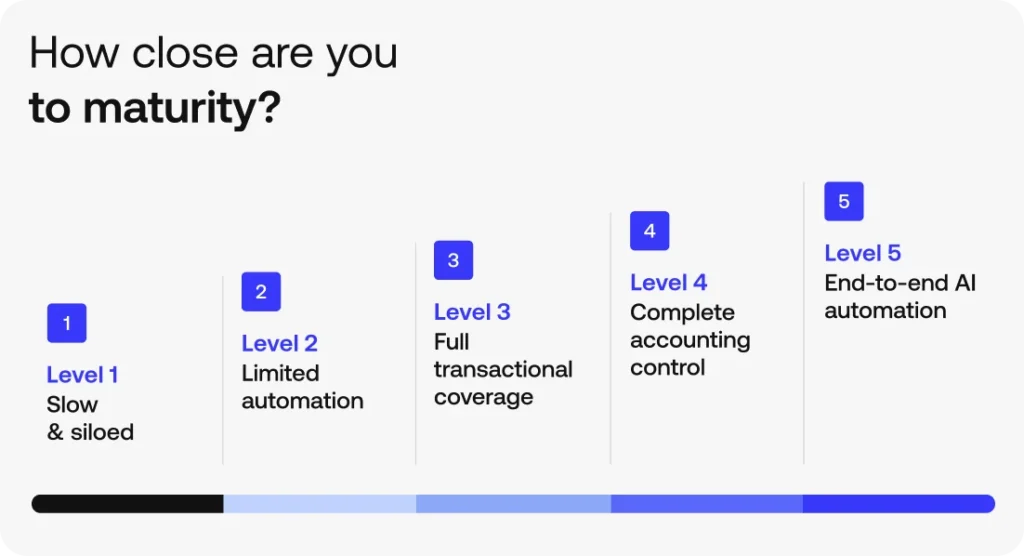

The Simetrik reconciliation maturity model consists of five stages, starting with completely manual finance operations and ending with transformative, continuously improving reconciliation automation. From instant customer refunds and nuanced loyalty programs to advanced, predictive FP&A modeling, getting to Stage 5 will put you at a huge competitive advantage.

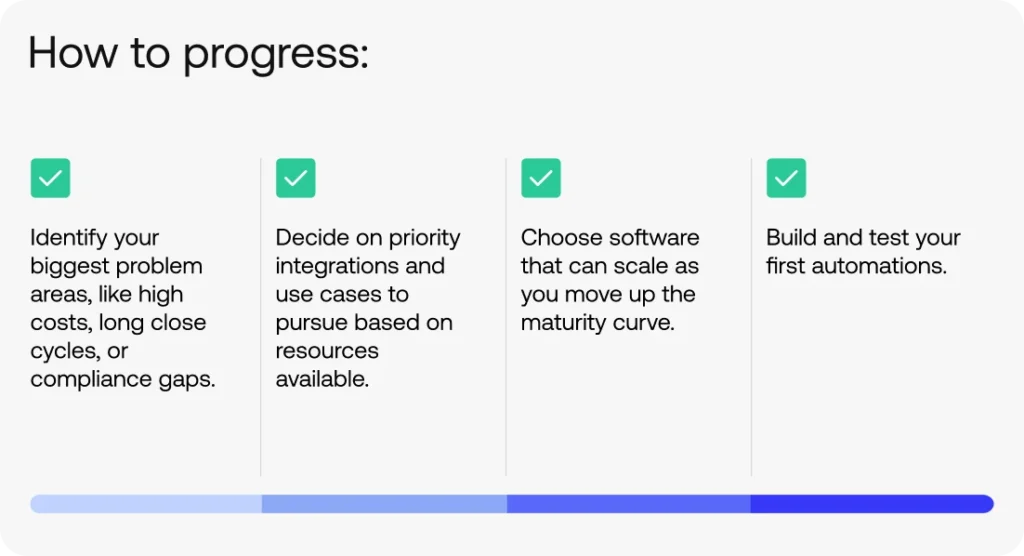

Stage 1: Slow & siloed

At the first stage, reconciliation is almost entirely manual. Minimal data integration, no scalability, and a lack of confidence in the numbers hurts the business.

- Data management: Spreadsheets and macros are the finance team’s primary tools, and siloed transaction data must be exported, validated, and entered correctly into backend systems.

- Development: Any attempt at integration or automation is reliant on engineering, so progress is slow and costly. There’s no path to leveraging AI or using transaction data in decisioning models.

- Exception handling: Finance teams manually check for discrepancies and fraud to a limited degree of success. When found, outreach and remediation can take weeks.

- Financial oversight: Little insight into current operational balances makes decision-making difficult. Transaction data often doesn’t match bank statements, bank balances, revenue forecasts, and other indicators of financial health.

- Accounting integrity: Transactional data is not aligned with operational balances or ledgers, slowing the financial close and often resulting in reporting errors.

- Risk: Risk is at a critical level, with many unexpected, unexplained losses and siloed internal knowledge. If a key employee leaves, they take the understanding of reconciliation logic with them.

- Compliance: Without audit trails, data must be compiled manually. Audits are costly and drawn out, and compliance gaps can lead to fees and reputational harm.

Stage 2: Limited automation

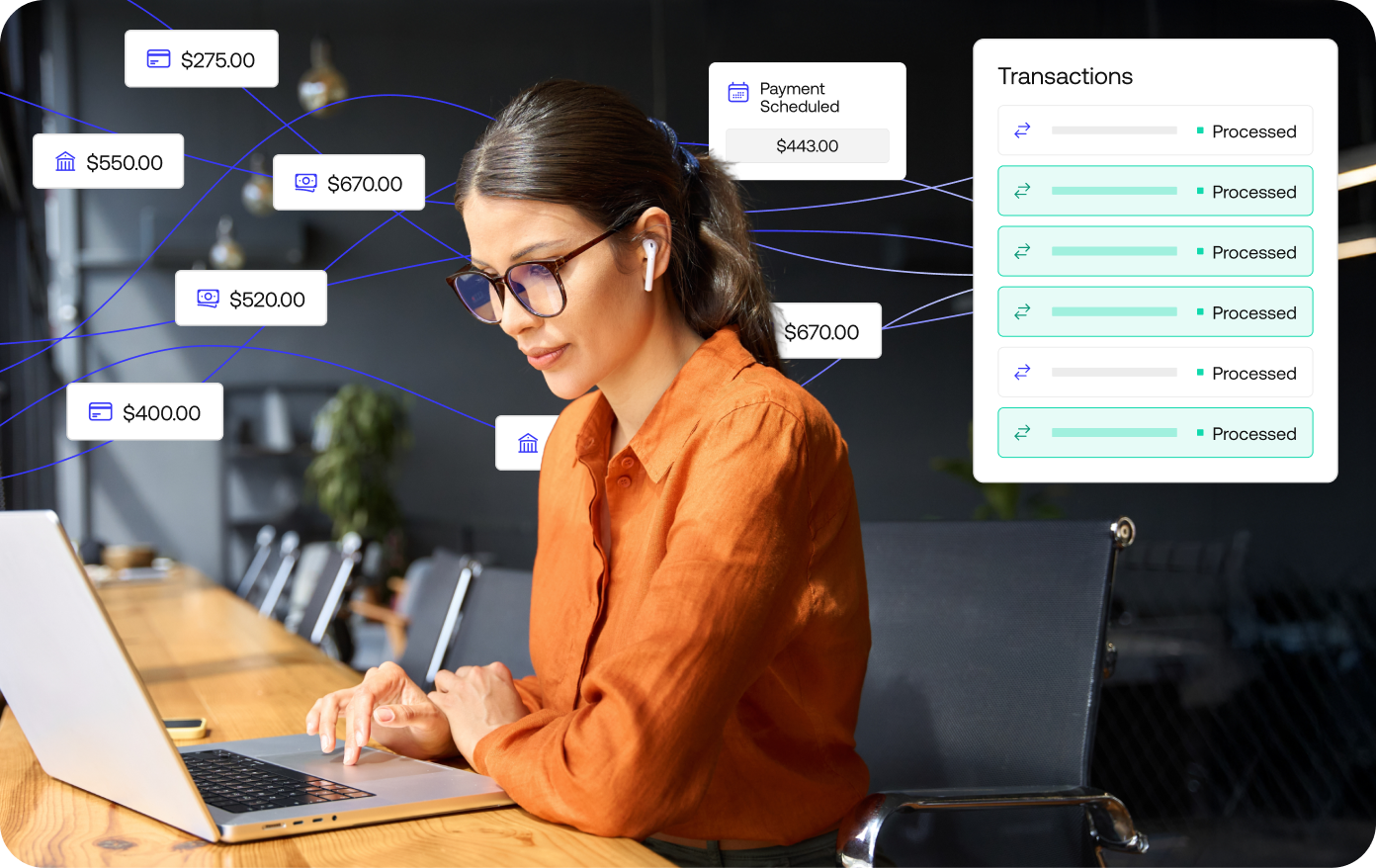

Benefits start to materialize at stage two, but reconciliation still isn’t scalable. With many data sources not yet integrated, AI adoption is not yet possible.

- Data management: Some integrations are in place, but transaction data remains fragmented. Manual data exports and spreadsheets are still common.

- Development: Automations are homegrown or piecemeal and rely on constantly changing logic and data sources. Engineering costs to add new integrations are high.

- Exception handling: Anomaly detection and transaction matching is automated for some sources, lightening the burden of exception management. Remediation is still entirely manual.

- Financial oversight: Increased visibility into transaction data helps with financial modeling and performance tracking, but isn’t enough to inform major decisions or drive AI innovation.

- Accounting integrity: Transactional data is still not aligned with general and sub-ledgers. Close cycles are long, and reporting is error-prone.

- Risk: Risk is still high, but the number of unexplainable losses starts to drop. Siloed internal knowledge is still a problem, with many black boxes across teams and information held by a select few team members.

- Compliance: Rev rec and reporting for standards like ASC 606 and IFRS 15 is manual and lacks complete audit trails. Internal audits can take months due to visibility gaps.

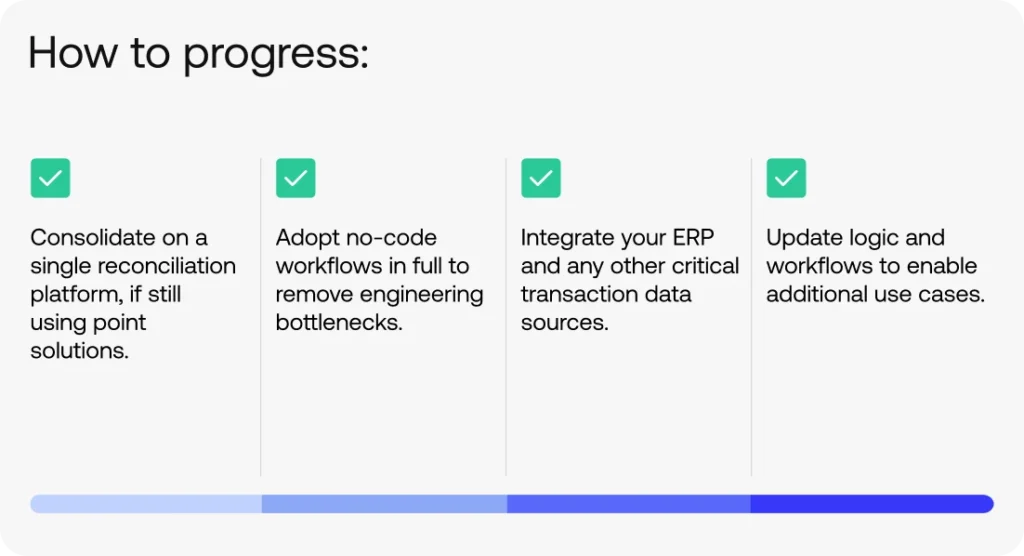

Stage 3: Full transactional coverage

At this stage, transaction-level reconciliation is fully automated, scalable, and prepared for financial reporting and downstream innovation. Accounting-level reconciliation remains manual.

- Data management: All transaction records are integrated, standardized, and automatically reconciled. Finance teams have real-time visibility into granular transaction details and discrepancies.

- Development: No-code tools and AI agents accelerate time to value and alleviate reliance on engineering as new workflows are needed. Anyone with permission can adapt the rulesets and business logic that power automated reconciliation and reporting.

- Exception handling: With the day-to-day reconciliation fully automated, team members can focus on exception handling. As discrepancies, chargebacks, disputes, and potential fraud are detected in real-time transaction streams, alerts tell the FinOps team it’s time for remediation.

- Financial oversight: Transaction data is occasionally reconciled against operational balances in the ERP, but records quickly outdated. Finance operations and accounting teams must manually compare ERP data with transactions for a true picture of the company’s finances.

- Accounting integrity: Accounting-level reconciliation is still manual. Transaction data doesn’t always match the GL and subledgers. The financial close takes days longer than it should due to manual data collection and reporting.

- Risk: Risk is greatly reduced due to transactional visibility, with losses easier to explain and quickly resolve. Knowledge of transactional reconciliation logic is accessible across the company—key employees can leave with zero disruption to the business.

- Compliance: Detailed transaction-level audit logs exist, but the audit process is still slowed by outdated reporting mechanisms. Documents are created manually or using scripts, without being connected to updated source data.

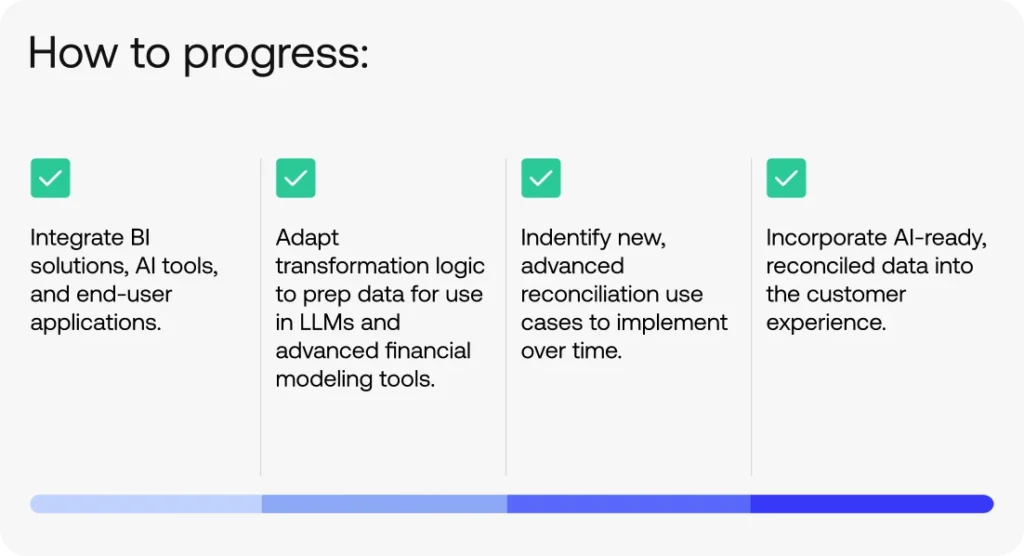

Stage 4: Complete accounting control

Transaction data is automatically reconciled against accounting balances. Accounting teams have dynamic, dedicated dashboards for the metrics they care about. Financial oversight is strong, but room for innovation remains.

- Data management: ERPs and other internal accounting systems are integrated alongside transaction data sources, all on a single reconciliation platform. Accounting teams can see always-updated, reconciled journal entries in the GL and sub-ledgers.

- Development: Users can deploy no-code workflows and update accounting rulesets to correctly transform data and sync it with the ERP. AI agents simplify the process of automation without diminishing control.

- Exception handling: The accounting team receives real-time alerts for discrepancies between transactional data and accounting balances. Exceptions are caught and remediated before the end of the close period.

- Financial oversight: Data is synced at least daily with the ERP and prepped for downstream reporting and AI analysis. Finance leaders can make fast decisions without digging into transaction details.

- Accounting integrity: Accounting leadership can see calculated balances, auto-reconciled journal entries, and progress against the close at a glance. The financial close is reduced by an average of five days.

- Risk: Operational loss and revenue leakage happens rarely, with complete explainability. Finance operations, accounting, product teams, and leadership all have visibility into reconciliation logic without needing to understand code.

- Compliance: Transaction- and accounting-level audit logs accelerate compliance efforts and minimize cost. Reporting is automatically tailored to relevant regulations and internal compliance requirements.

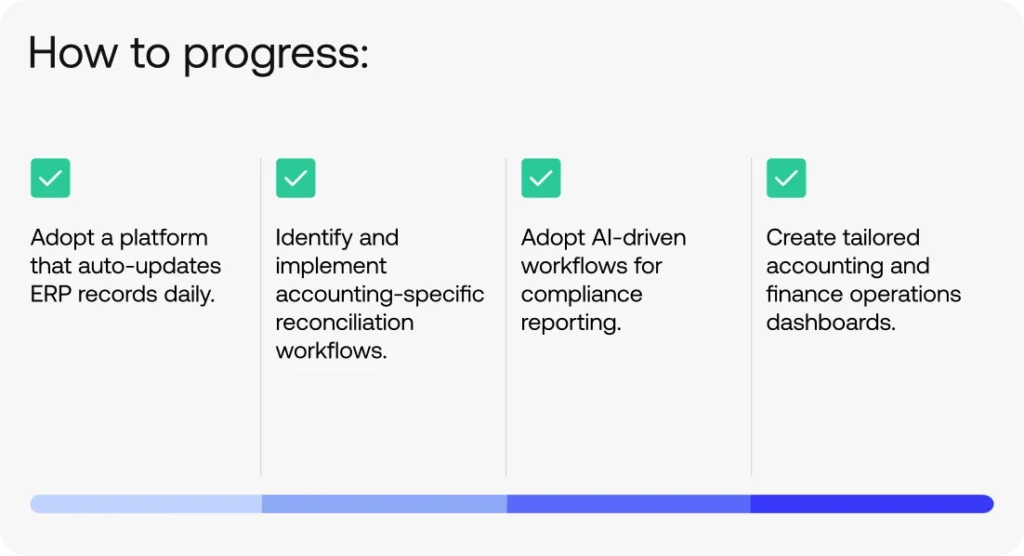

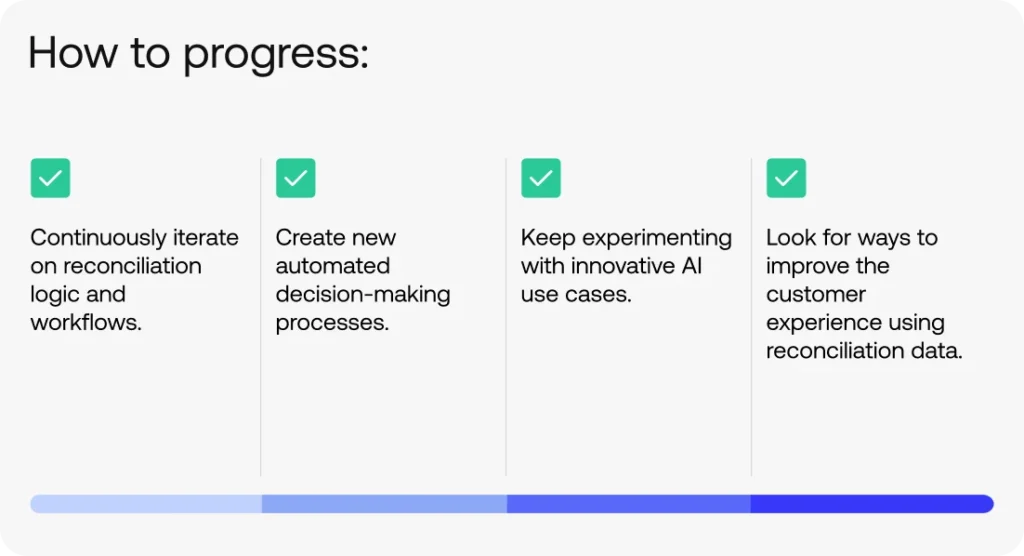

Stage 5: End-to-end AI automation

The final stage is an ongoing journey of iteration, scale, and increased ROI. New use cases are continuously deployed with zero code. AI agents learn and suggest improvements as the business and ecosystem evolves.

- Data management: Every data source, internal and external system, and regulatory requirement is unified on an AI reconciliation platform. Adding a payment partner, adapting to new laws, and expanding into new markets is painless.

- Development: Scalable, no-code automation makes adding a payment partner, adapting to new laws, and expanding into new markets painless. Massive changes to the financial ecosystem no longer pose a threat.

- Exception handling: Agentic AI powers every step of risk detection and exception management. Users manage sophisticated automations that quickly remediate issues like chargebacks, disputes, and refunds.

- Financial oversight: AI-ready, reconciled data powers a multitude of innovative financial modeling, forecasting, and performance tracking. New use cases are easy to implement as requirements change.

- Accounting integrity: The books always align with transactional data. AI agents drive a fully automated and auditable financial close, with reporting and documentation dynamically aligned to evolving IFRS standards and business-specific workflows.

- Risk: Risk due to reconciliation errors is eliminated, with advanced predictive models and no-code automation driving complete transparency across the org.

- Compliance: AI agents and intelligent logic powers adaptive, accurate reporting across many internal and external compliance use cases.

What’s next on the path to maturity?

Now that we’ve laid out a vision for full reconciliation maturity, it’s time to get to work. Plot yourself on the model, outline next steps, and prioritize the use cases that are most likely to move you to the next stage.

At Simetrik, we’ve helped finance operations teams across top financial services, retailers, and marketplaces move from costly manual transaction matching and reporting to AI-enabled, fully automated reconciliation.