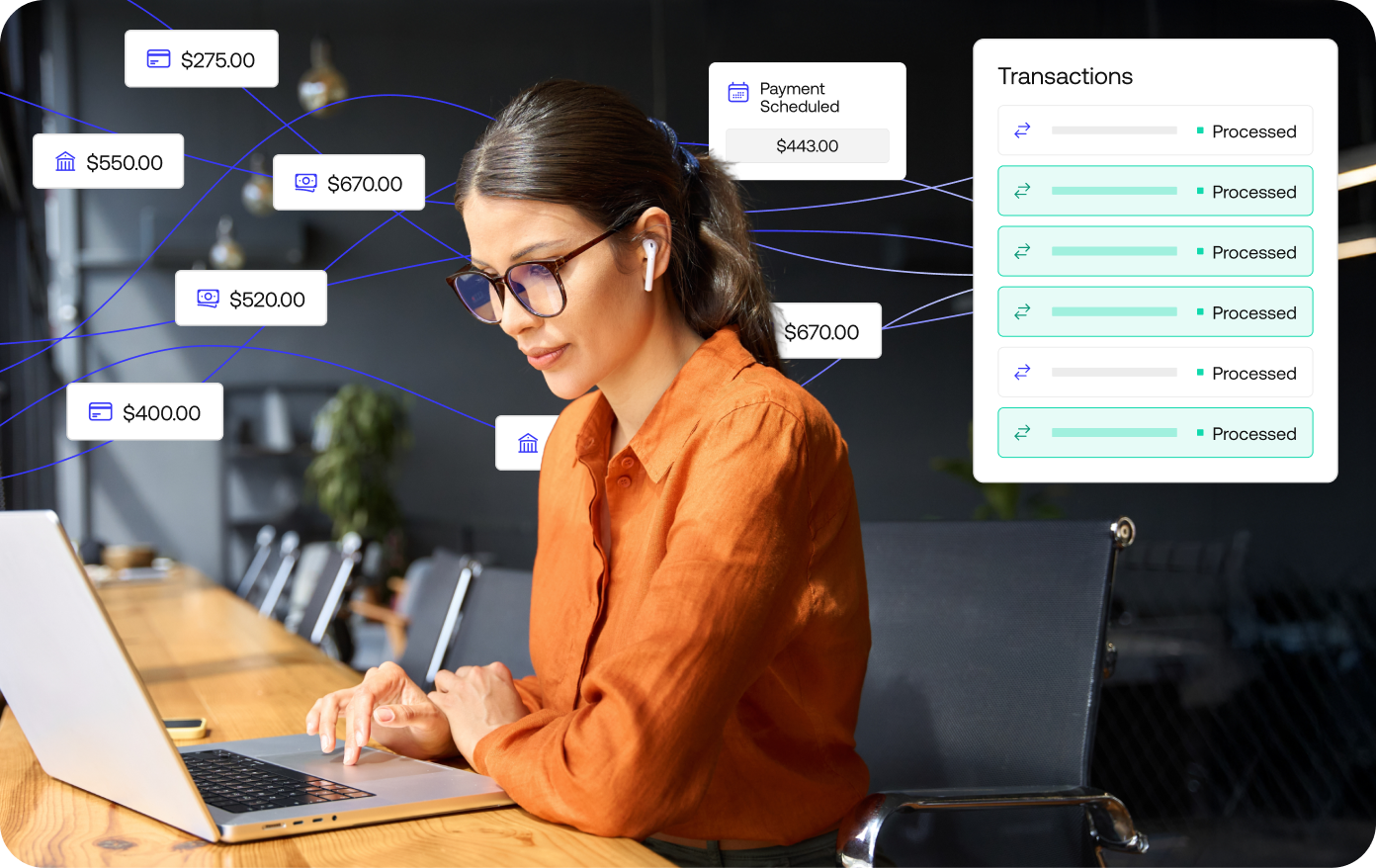

If you work in card payments, you already know the feeling: a network file lands at 3:07 a.m., a processor export shows up at 3:12 a.m., and by 9:00 a.m., your operations team is trying to explain why a handful of transactions don’t line up with anything. Somewhere, a compliance partner is asking for sub-merchant chargeback trends. Somewhere else, an engineer is rewriting a rule and planning yet another redeploy.

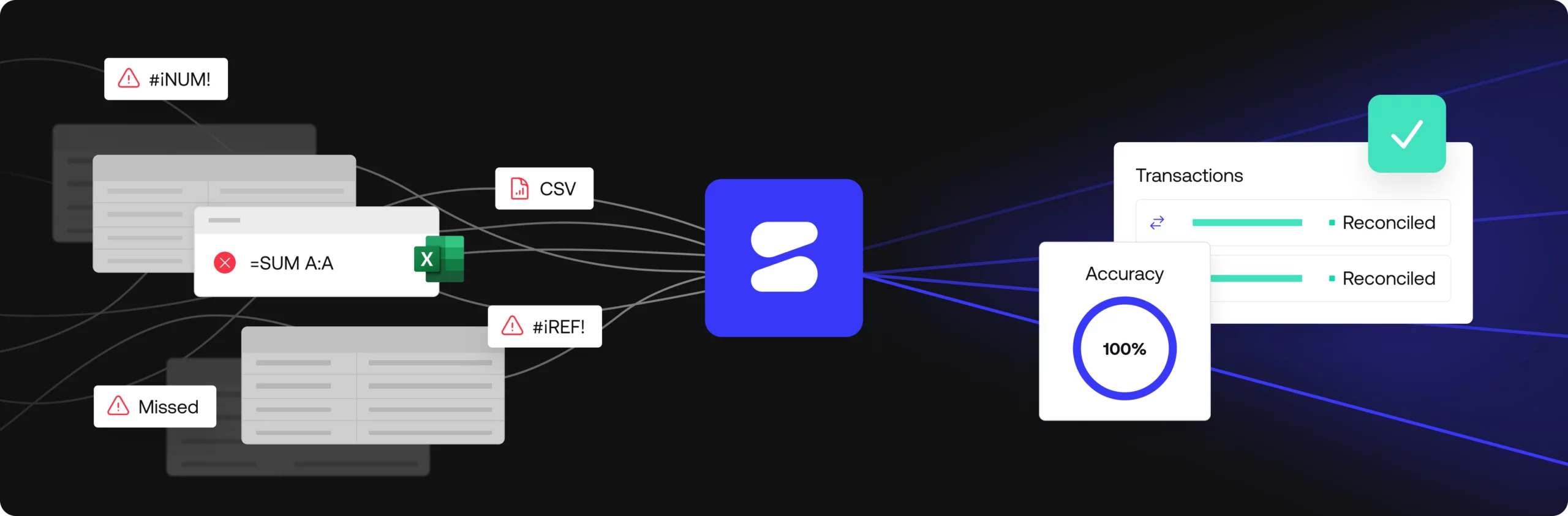

With automated reconciliation, you’ll never have to deal with this scenario again. Simetrik’s reconciliation platform streamlines transaction processing and matching in one place, simplifying all the downstream workflows that follow.

This post turns a live platform walkthrough on the platform—centered on reconciling processor files (think Stripe/Checkout.com) with network files (Visa/Mastercard) and then packaging the results for finance, ops, and compliance—into a practical blueprint for cost and variance control, optimal liquidity, and stress-free regulatory reporting.

The reality on the ground

Here’s the truth most teams quietly share:

- Data variety is exploding across many participants, systems and formats, and s in the payments value chain. Networks, processors, gateways, banks, internal ledgers, ERPs, bank statements, settlement files, dispute/chargeback feeds—each with its own lifecycle and set of processes.

- Rules change constantly. Networks revise specs and set mandates, partners add columns, merchants expand cross-border, and your team adds new products (like instant payments or a crypto wallet) to stay competitive in the market.

- Engineering is a bottleneck. Your rules live in code. Adjustments require a PR, a redeploy, and cross-team coordination. That’s not “operations”—that’s software development.

- Visibility is fragmented. You can produce totals for billing (mostly). But surfacing discrepancies, their root causes, and sub-merchant trends on chargebacks? That still takes a hunt through SQL, email threads, and some good luck.

If any of that reads a little too familiar, keep going.

The five tenets of modern reconciliation (and how Simetrik implements them)

1) Ingest anything, as-is

Goal: Treat inbound data like a first-class citizen, not a problem to be “pre-cleaned.”

How it works in practice: Simetrik Sources accept raw files—network packages, processor exports, bank statements, dispute/chargeback feeds—exactly as they come. If a single PDF or flat file contains 30 tables, we extract the tabular parts, keep each table as a distinct Source, and retain the original structure for audit. No pre-transformation scripts, no brittle staging jobs. Just drop files via SFTP/secure bucket/API and let the platform build structured tables that “look like a spreadsheet” but scale to billions of rows.

Why this matters: It short-circuits the classic “we’ll fix the data before it hits the tool” trap. You won’t. And you shouldn’t have to.

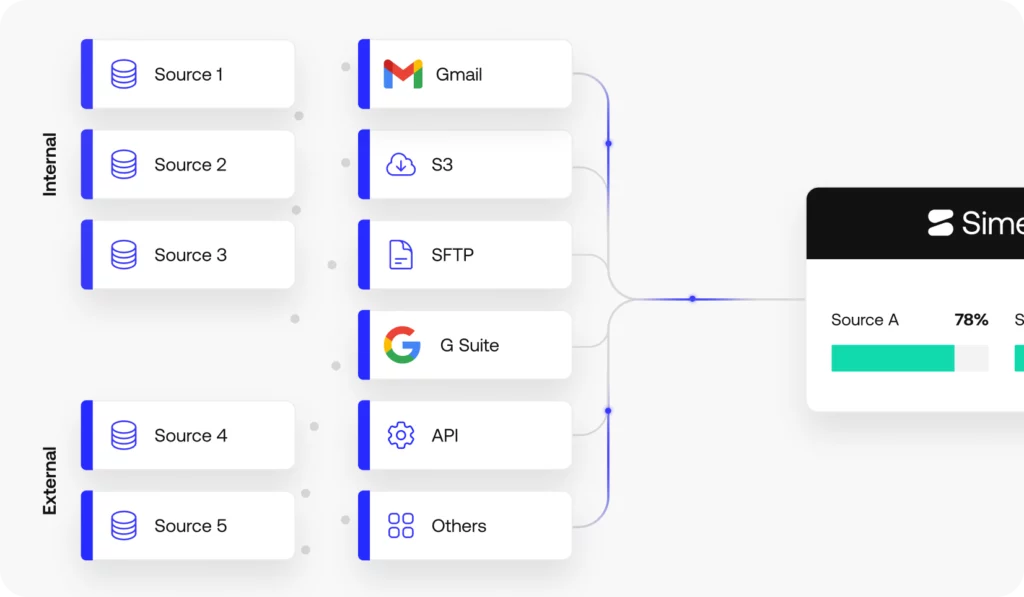

2) Normalize for resilience (hello, Source Union)

Goal: Make format drift a non-event.

How it works: Simetrik’s Source Union maps heterogeneous partner files to your standard schema. If Visa changes a column name next Tuesday or a processor inserts a new field on Thursday, you remap in the UI, keep your history intact, and move on. You can unionize dozens—or hundreds—of partner sources into one “canonical partner feed,” then compare that to your internal ledger, your network settlements, or both. Best of all, Simetrik’s AI, through its suggestions and normalization, and autocomplete features, guides you and makes the process even easier.

Why this matters: Reconciliation shouldn’t break because someone added Ref2 next to Ref1. Normalization is an operational capability, not a one-off project.

3) Match with no-code logic (rules and rule sets)

Goal: Put the brain of reconciliation where it belongs: in the hands of the operations and finance teams who own the outcomes.

How it works: Simetrik lets you define Rules (e.g., amount = amount, currency = currency, date within T+1, reference A ~ reference B) and group them into Rule Sets with priority. Start strict—amount + currency + multiple references + settlement date tolerance; then gracefully relax (e.g., fall back to a secondary reference parsed from a long string). Add as many Rule Sets as you need. There’s no hard limit; some customers operate in the triple digits for maximal automation.

Why this matters: You shouldn’t open a ticket to tweak matching logic. Period. When operations can adjust rules in minutes, discrepancies stop piling up, engineers get their weekends back, and audit trails get clearer, not messier.

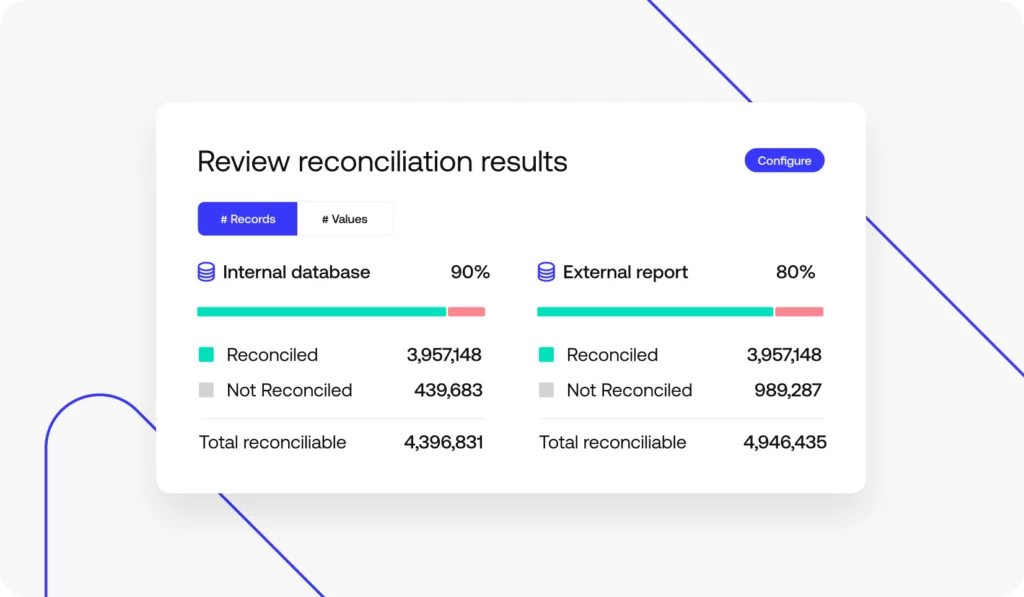

4) Analyze results like a product, not a spreadsheet

Goal: Turn reconciled outputs into living intelligence.

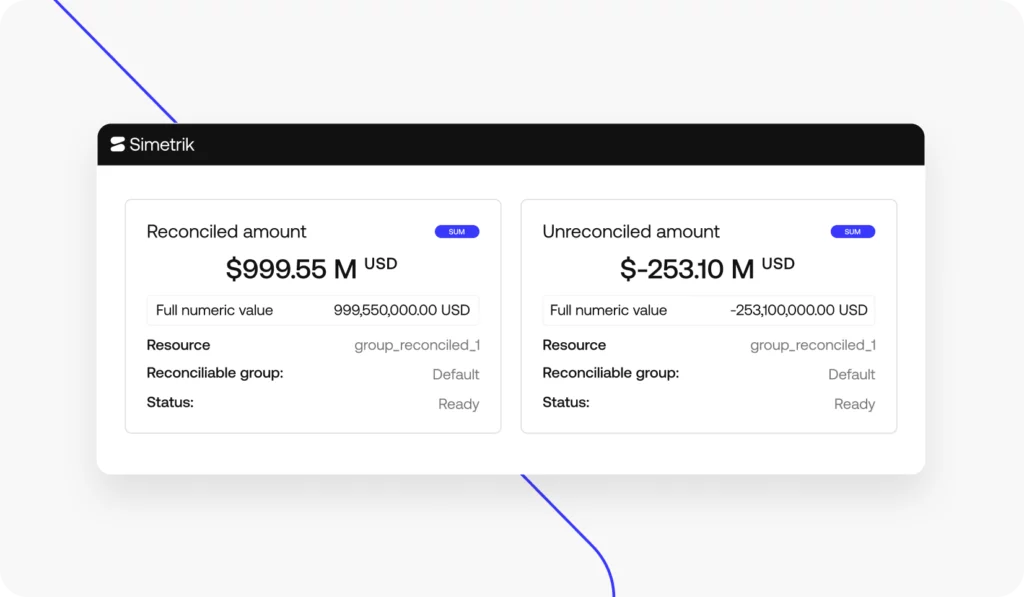

How it works: Every reconciliation produces a results table (again, think spreadsheet UX with database scale). From there, build dashboards to answer the real questions:

- What % reconciled today, and what’s the value of the delta?

- Which partners or geographies contributed most to unreconciled volume?

- Which Rule Set cleared each transaction? (For audits, this is gold.)

- Where are fee variances, FX impacts, and take-rate swings?

- What’s the chargeback rate over time per sub-merchant, brand, BIN, or country?

- Are processors complying? Where’s my CBK data? Was it all booked right?

You can go from transaction-level detail to executive summaries in a couple of clicks – and back again-, and you can export or schedule the reports you owe to clients and regulators.

Why this matters: Reconciliation is not just “making files equal.” It’s a control function and an analytics function. Treat it like one.

5) Control the process (alerts, SLAs, and completeness checks)

Goal: Put exceptions on autopilot

How it works: Set thresholds and alarms across the lifecycle: “Expected file not received,” “reconciled rate < 99.5%,” “chargeback rate for Merchant X > Y% day-over-day,” “fee variance exceeds tolerance.” Route alerts to Slack/email, open a task, and attach the exact rows in question. You can also track amounts, not only counts—because three unreconciled transactions totaling $250,000 are more urgent than 300 for $12.60.

Why this matters: Controls are what separate a working process from a nightly fire drill.

A walk-through: reconciling processor vs. network, end-to-end

Let’s put the pieces together in the most common payments-ops flow.

Step 0: Drop files

- Acquirer processor daily transactions (e.g.,Global Payments, Fiserv)) → SFTP folder.

- Network settlement package (Visa/Mastercard) → SFTP folder.

- (Optional) Bank statement & dispute/chargeback feed → SFTP folder.

Simetrik picks them up automatically and renders them as Sources.

Step 1: Normalize partners

- Use Source Union to map and enrich processor files into a common structure (dates, amounts, currencies, multiple reference columns).

- Keep a separate union for network files if needed.

Step 2: Prepare the data

- Add enrichment columns (purple columns in the UI): fees per txn, FX conversions, derived references extracted from long strings, standardized timestamps, etc. These are formula-like, documented, and auditable.

Step 3: Define matching

- Rule Set 1 (strict): amount == amount, currency == currency, auth/reference match among any of {R1,R2,R3}, settlement date within tolerance, identical payment method.

- Rule Set 2 (fallback): If R1 fails, parse fallback reference from long entry string; allow ±1 day settlement drift; permit minor rounding differences.

- Rule Set 3 (edge cases): Gateway-specific quirks, cross-border FX rounding thresholds, partial captures/refunds logic.

Priority executes top-down. Each matched pair records which Rule Set did the job.

Step 4: Review results

- Dashboard shows total records, matched %, unmatched count, and unmatched value.

- Drill into unreconciled transactions by partner, payment method, merchant, and geography. See the exact reason each row failed (e.g., missing reference, amount variance, settlement drift beyond tolerance).

Step 5: Act and export

- Trigger alerts if KPIs fall below thresholds.

- Export client-facing reports (daily summaries, settlement confirmations, fee breakdowns) automatically.

- Keep the audit trail: original raw data, transformations, rule logic, user actions, timestamps.

That’s the flow. No redeploys. No “who changed the rule last week?” Just operational control.

Chargebacks & sub-merchant visibility: the compliance must-haves

Card networks expect principal members and their sponsor banks to know their sub-merchants: volumes, chargeback rates, and how those metrics change over time. In practice, that means two things:

- Unify the view. Chargeback feeds often live in their own silo. Bring them into the same model as authorizations, captures, refunds, and settlements. When a chargeback deduction has no underlying transaction match, flag it as revenue leakage and quantify the impact.

- Trend granularly. Track chargeback rates per sub-merchant, per brand, per country, per BIN, daily. Alert on spikes. Show both counts and amounts. For teams that report to networks, regulators, or enterprise merchants, being able to slice and ship that report in minutes is the difference between “we’re on top of it” and “give us a week.”

Simetrik’s analysis module was built for exactly this level of slicing. If you can describe the cut, you can chart it—and schedule it.

Performance and scale: two non-negotiables

A common question: What happens when we run a million transactions through dozens of Rule Sets?

Short answer: the system is designed for it. Customers run into the hundreds of millions of records per day across multiple reconciliations, with execution measured in minutes. Matching is parallelized, transformations compile down efficiently, and unions avoid the rework of one-off pipelines. The practical benefit: teams can ratchet up automation (more Rule Sets) without worrying that each new edge case will drag the nightly run into the next day

Build vs. buy: the honest math

If you’re already halfway through building an in-house reconciliation platform, you’re not alone. Many teams start there. The core trade-offs we see:

- Time to adapt: In-house rules = code = sprint time. Simetrik rules = UI = minutes. The gap compounds every time a spec, partner, or product changes.

- Coverage: In practice, internal platforms hit ~60% coverage first, then progress slows as long-tail exceptions consume engineering cycles. Simetrik flips that: operations expand rules as they learn, quickly squeezing the tail.

- Auditability: Regulators and auditors love an immutable source record, clear transformations, and a row-level trail of which rule matched what. You can build that in-house, but it takes a lot to build it well.

- Opportunity cost: Every hour your engineers spend on reconciliation is an hour not spent on customer-facing features, risk systems, or issuer/acquirer enhancements.

Simetrik prices by data processed (not by number of rules, users, or dashboards), which aligns incentives: bring more sources in, automate more reconciliations, and expand visibility without worrying that “one more use case” breaks the budget.

What “good” looks like after go-live

Within a few cycles, teams that implement a universal reconciliation approach typically report:

- >99.95% matched daily, with the remainder explainable and trending down.

- Exception queues that are focused, small, and attributable (e.g., “missing network reference for Processor X on YYYY-MM-DD”).

- Automated reporting to networks, merchants, partners, and internal finance—delivered on time, with the same definitions every day.

- Chargeback intelligence delivered by sub-merchant and geography, with alerts on spikes and easy exports for network reviews.

- Fewer tickets to engineering, because ops owns the knobs. Developers still build, they just build things that move your product forward.

The best part is, your next integration doesn’t mean “start a new mini-project.” It means “add a Source, update the Union mapping, extend a Rule Set.” It’s an entirely different operating model.

A short plan you can actually follow

If you want to test whether this approach works for your stack, here’s a pragmatic six-week outline:

- Week 0–1: Connections. Set up SFTP/API to drop processor, network, and (optionally) bank/chargeback files daily.

- Week 1–2: Normalize. Build the Source Union(s) for processor and network feeds. Add 3–5 enrichment columns you know you’ll need (fees, FX, parsed references).

- Week 2–3: First reconciliation. Define 3–5 Rule Sets to cover 80% of volume. Run two weeks of historical data to validate.

- Week 3–4: Exceptions & dashboards. Create unreconciled root-cause views. Stand up chargeback and sub-merchant dashboards. Enable alerts.

- Week 4–5: Iterate. Add long-tail Rule Sets to squeeze remaining exceptions. Validate exports your clients need (CSV/XLS, SFTP delivery).

- Week 6: Review. Compare run-time, match rates, and effort against your in-house baseline. Decide whether to expand to additional networks/processors or add bank settlement reconciliation.

It’s deliberately lightweight. The goal is proof—of-coverage, of control, and of speed.

And if you use our pre-configured solutions, available for specific partners such as Visa and Mastercard, you can cut this time in half.

Final thought: make reconciliation boring (in the best way)

Reconciliation will never be glamorous. But it should be predictable, explainable, and fast. Your teams should spend their energy on insights and decisions rather than chasing down errors. Auditors should relax when they see your logs, not mentally tack on another six weeks of discovery. And when a partner changes a column name on a Thursday, it should be a two-minute fix, not a post-mortem.

That’s what we build for at Simetrik: an operating system for financial data quality—rooted in workflows you can trust, matching logic you own, analytics that tell the story, and controls that keep you ahead of the next review.

If you’d like to see this with your own data—processor, network, bank, chargebacks—we’re ready to plug in. Bring your messy files and we’ll clean it all up on Simetrik.