The payments landscape is a multi-trillion-dollar industry that touches nearly every corner of the world. Transactions increasingly happen in near-real time across many participants — the average payment touches 5-7 intermediaries, and platforms and marketplaces now process an estimated 30% percent of global consumer purchases.

This complexity greatly complicates the role of treasury and finance teams. Variance among currencies, settlement times, and data management protocols makes it hard to track liquidity and accurately apply cash at scale, often leading to millions of unaccounted-for dollars a year.

How can the office of the CFO tackle liquidity and forecasting challenges when money moves faster than it ever has? Keep reading for the answer – and a look into the emerging world of AI reconciliation.

What’s so hard about liquidity management?

Treasury and finance teams used to be able to rely on batch settlement data to understand their cash positions. With the proliferation of flexible payment methods and new payment services, complexity grew.

The addition of real-time payment (RTP) networks brings even more nuance and risk to the market. These new payment rails give businesses faster ways to handle payroll, pay out merchants, and manage AR/AP – they also tend to push internal reconciliation and finance teams to the limit.

The challenges to managing liquidity effectively today include:

- Funds come and go many times throughout the day. Without a continuous tracking system, finance teams can’t be sure enough cash is available at any given point.

- Settlement times vary and don’t always coincide with transaction time stamps. Bank balances may be off by thousands of dollars, leading to poor funding decisions, unplanned fees, and unnecessary panic.

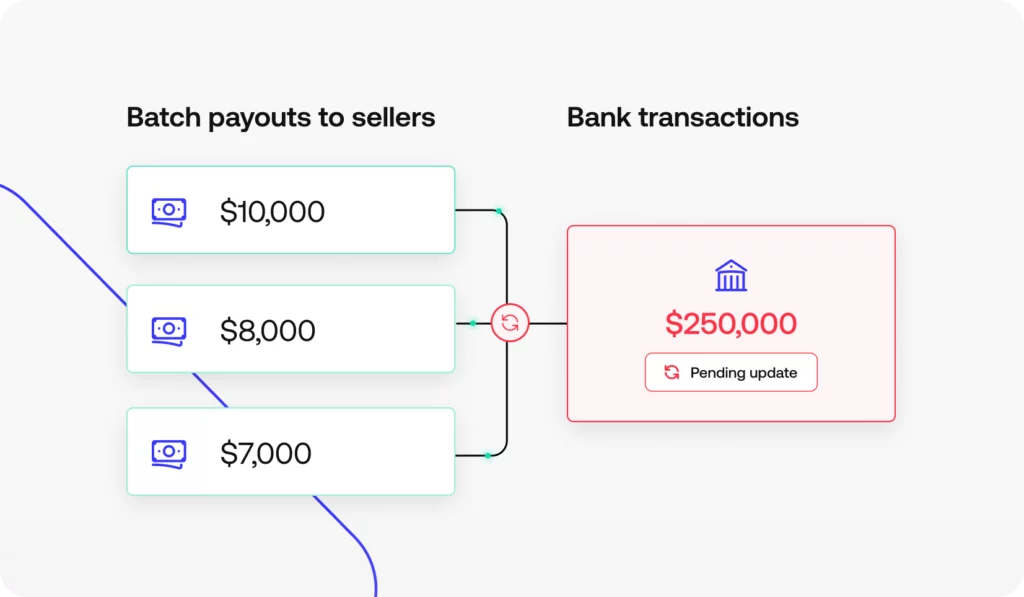

- Batch payments don’t map back to individual transactions. This adds hours of manual reconciliation to ensure cash and fees are applied correctly.

- Discrepancies and errors slow reconciliation and make it hard to calculate cash on hand.

Move too cautiously, and the opportunity cost is steep. Cash sits idle in accounts instead of being deployed to fund growth or reduce short-term borrowing. Move too aggressively, and you risk the opposite problem.

Underfunded RTP accounts, for example, can break funding agreements with sponsor banks – the very relationships that make instant payments possible. Without timely reconciliation, teams may not realize how quickly real-time payouts are draining balances until transactions start failing.

Cross-border settlements introduce another layer of complexity. Funds often pass through multiple correspondent banks and FX providers before reaching their destination. When timing or conversion delays aren’t captured immediately, treasury teams can mistake in-transit balances for available cash, exposing the business to liquidity gaps and currency risk.

Merchant payouts add risk, too, as marketplaces and retailers often pay merchants ahead of card network settlement. Without clear visibility into pending inflows, finance teams may overextend working capital, effectively funding payouts with money that hasn’t yet arrived.

To accurately monitor liquidity and maintain a clear line of sight into balances, AR, and AP across your entire payments ecosystem, look no further than reconciliation.

The role of reconciliation in understanding liquidity

Reconciliation helps finance teams manage liquidity and cash flows by maintaining accuracy and financial integrity at every step of every transaction.

At the most granular level, the reconciliation process validates and matches transaction records across all parties. At a higher level, it ensures operational balances accurately reflect the reality of the company’s cash position.

Once reconciled, the data can be used to make all kinds of decisions about liquidity: whether to acquire more funding, what payment terms to offer or accept, how to allocate working capital, and many more.

But while AI and automation have transformed other key enterprise workflows, too many companies have yet to invest in modern reconciliation solutions that can handle the volume and complexity associated with real-time, global payments today.

The problem with legacy financial platforms

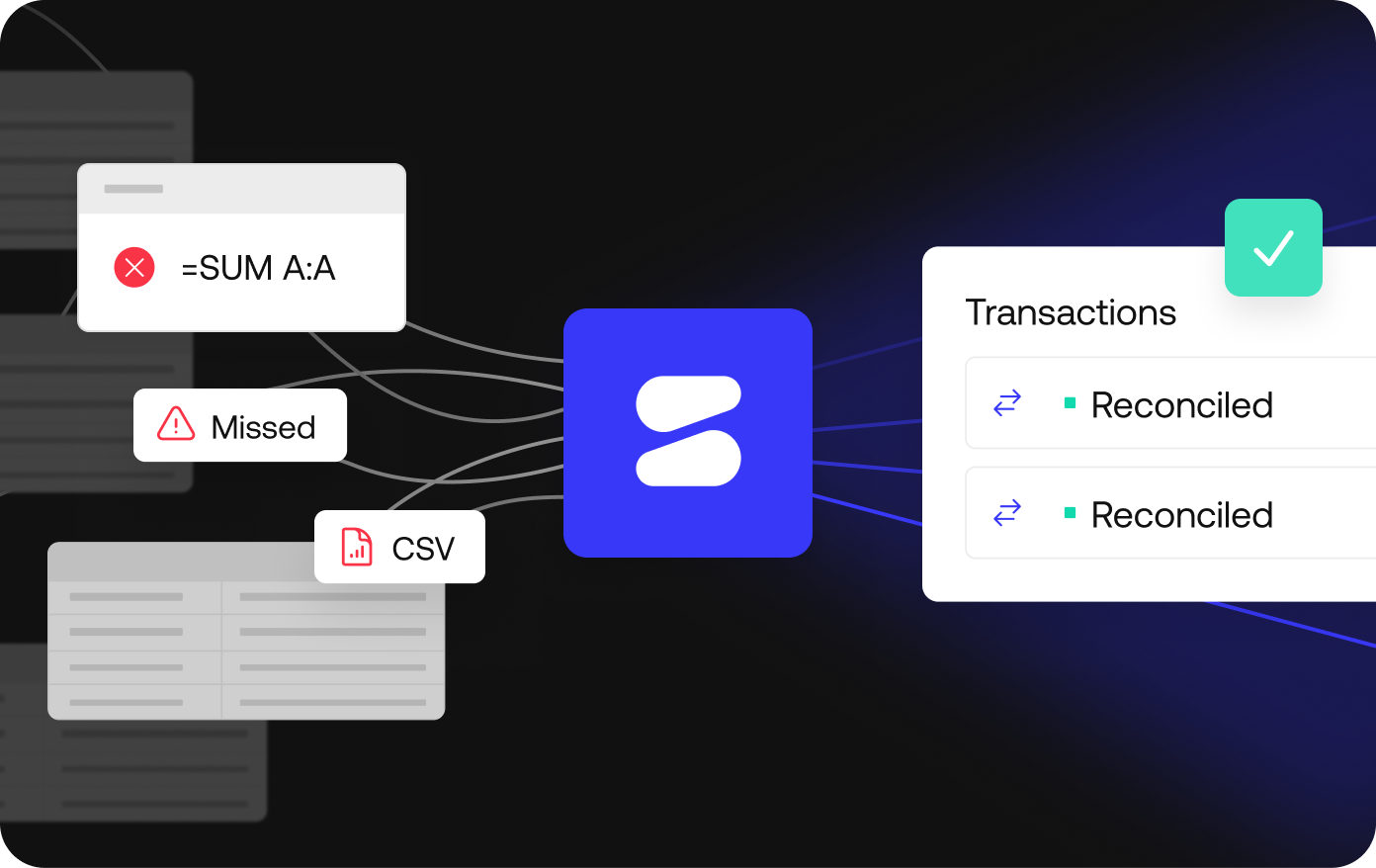

Many finance teams still rely on manual entries, spreadsheets, and brittle systems that can’t paint a real-time picture of cash flows and liquidity. Even with a strong treasury management system (TMS), the gap between balances shown in banking systems or financial analytics tools vs the reality of minute-by-minute transactional data leads to substantial discrepancies and excess costs.

Legacy, manual solutions aren’t just slower, they suffer from poor interoperability – too many disparate data formats, currencies, and protocols muddy visibility and hinder finance teams’ ability to use reconciled data for critical decision-making around liquidity.

Fragmented tech stacks also force engineering to spend time on costly integrations and workarounds, rather than working on initiatives that will eventually drive revenue. The bottom line? It’s expensive to stick to the status quo.

AI-powered transaction reconciliation: the key to transforming liquidity management

AI reconciliation gives finance teams the tools they need to understand their cash position and make profitable decisions around working capital and funding. Modern reconciliation platforms automate the majority of transaction processing and reconciliation while maintaining complete control, generating accurate dashboards and reports to drive smarter liquidity decisions.

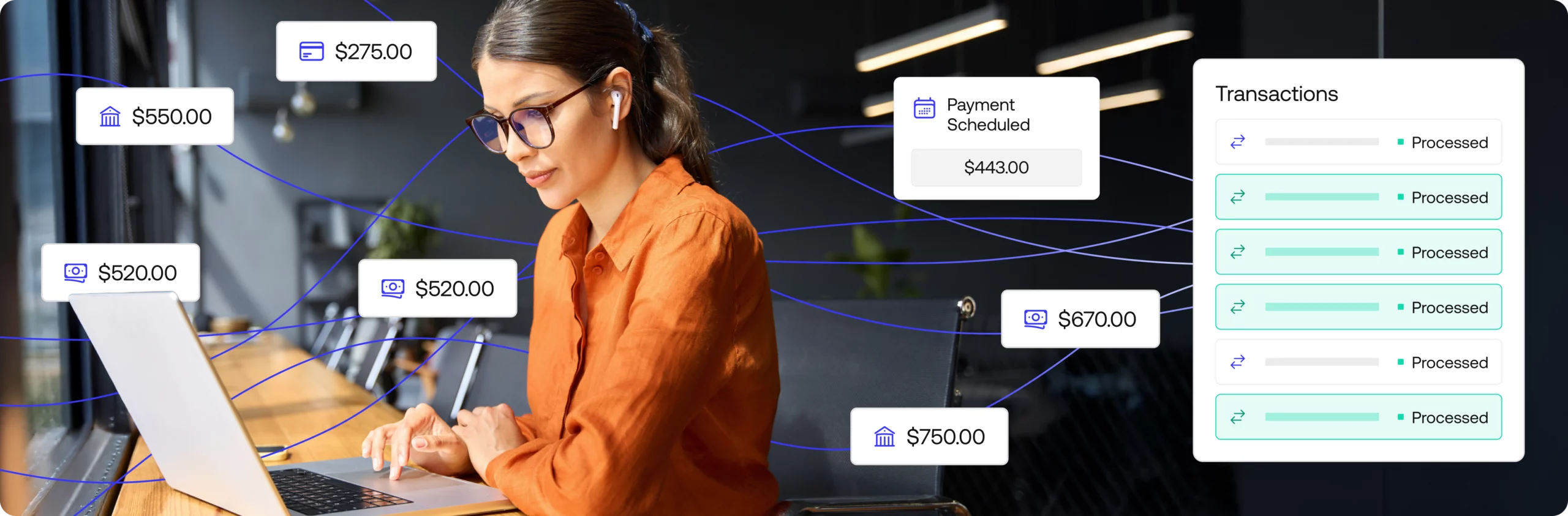

These newer, AI-enhanced systems are designed to handle exactly the kind of high-volume, complicated transaction data that enterprise finance teams struggle with. Each incoming and outgoing payment is instantly validated, matched across every party involved (PSPs, real-time payment rails, card networks, etc.), and applied to the correct customer and account.

Unlike legacy and manual solutions, AI reconciliation centralizes all of your transaction and finance operations data into a single source of truth, enriching records and filling in gaps automatically so balances can be updated in real time. This results in a complete, clear picture of your cash position at any given point in the day, as well as granular transaction data that can be used to optimize prefunding on real-time payment rails.

Treasury and finance decision-makers can log into their TMS, business intelligence tools, ERP, or any other connected system and work from the same data, eliminating the guesswork from liquidity management altogether.

Strengthen liquidity with complete visibility and control on Simetrik

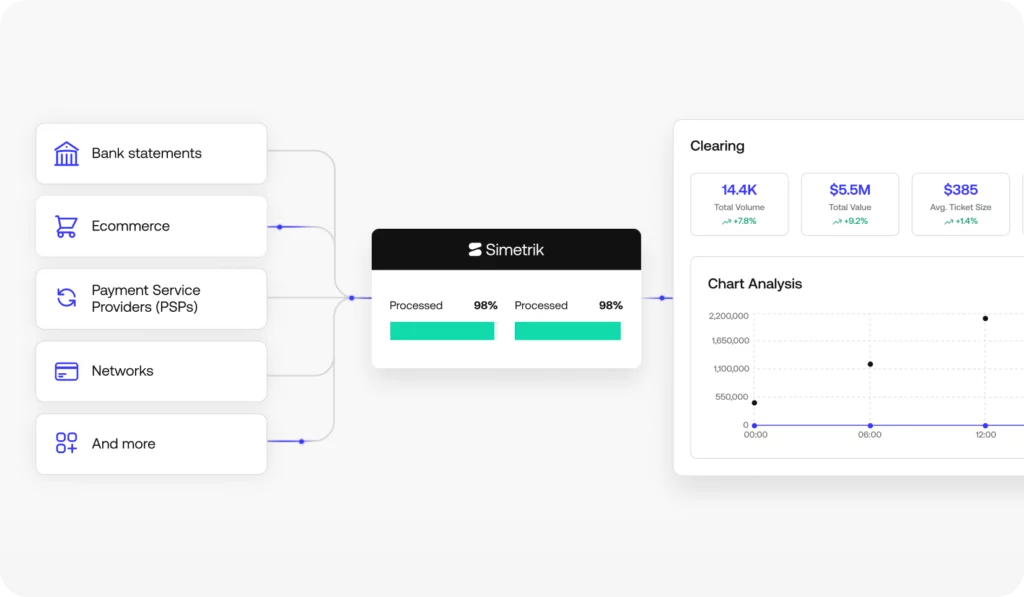

Simetrik is an AI reconciliation built for highly complex, heavily regulated finance operations where liquidity management depends on real-time visibility.

The platform ingests transaction data from any source and system, processing it according to configurable, AI-driven logic. Every incoming payment is applied instantly to the right invoices and updated in your ERP to paint a complete picture of your cash position—even if settlement hasn’t happened yet.

This level of automation and efficiency lets your finance team focus solely on exception management and accurate forecasting. Simetrik ensures that:

- Operational balances always accurately reflect transaction data

- Prepayments and credits are factored into cash positions

- Batch payouts and bulk payments from PSPs are automatically disambiguated

- Follow-up on aging receivables is automated to collect more revenue

- Fraud and risk models are improved with trusted, reconciled data

- Errors and discrepancies are automatically addressed upon discovery

- Data in your TMS and ERP reflects true liquidity levels

Simetrik helps finance and treasury teams transform their operations while maintaining global governance and control. To learn more about how our AI reconciliation platform improves liquidity and drives profitable decision-making, explore our solutions or get in touch with us to schedule a demo.