Solutions

Use Cases

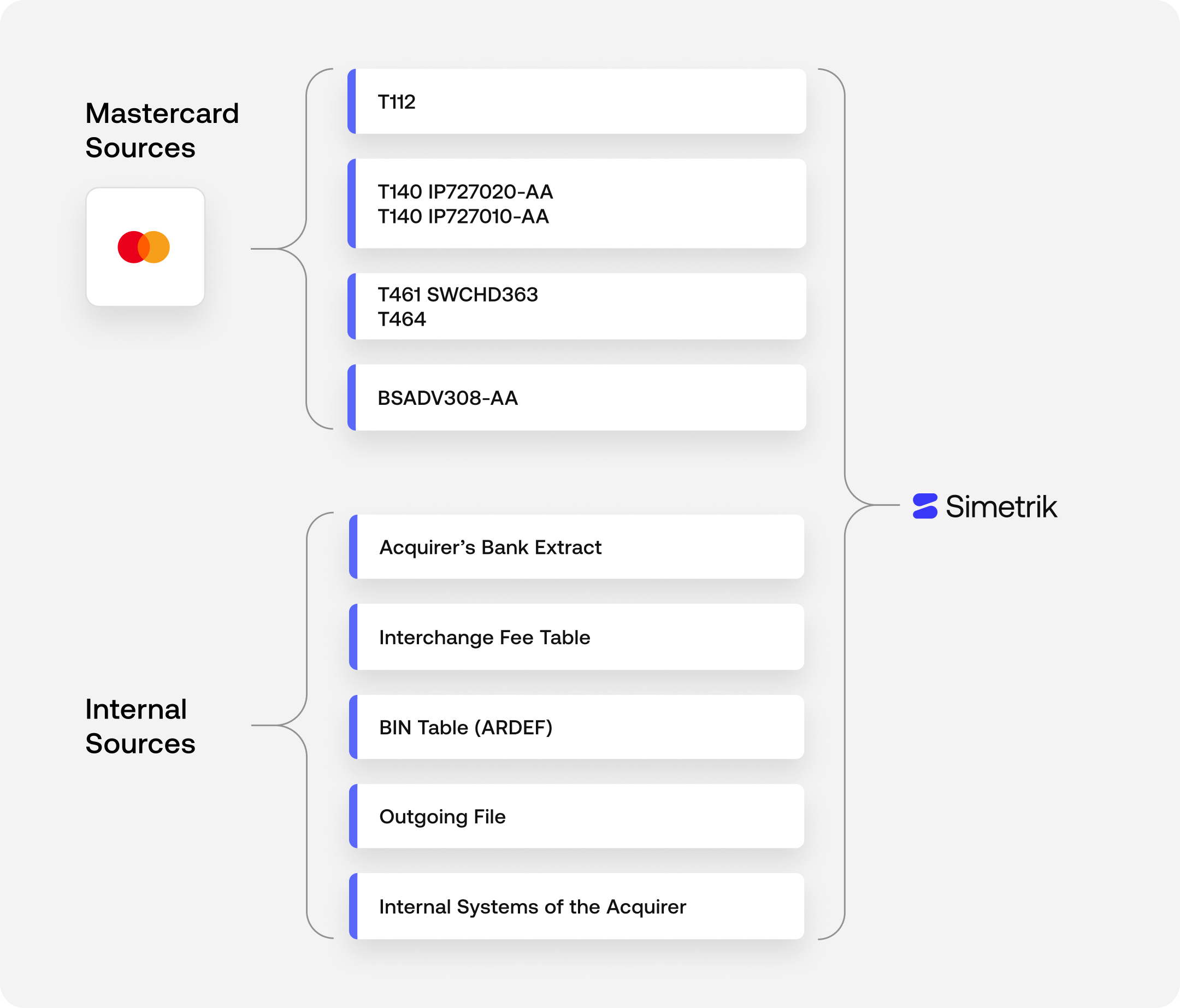

Launch preconfigured, domain-specific reconciliation workflows for Mastercard transactions for fast, measurable results.

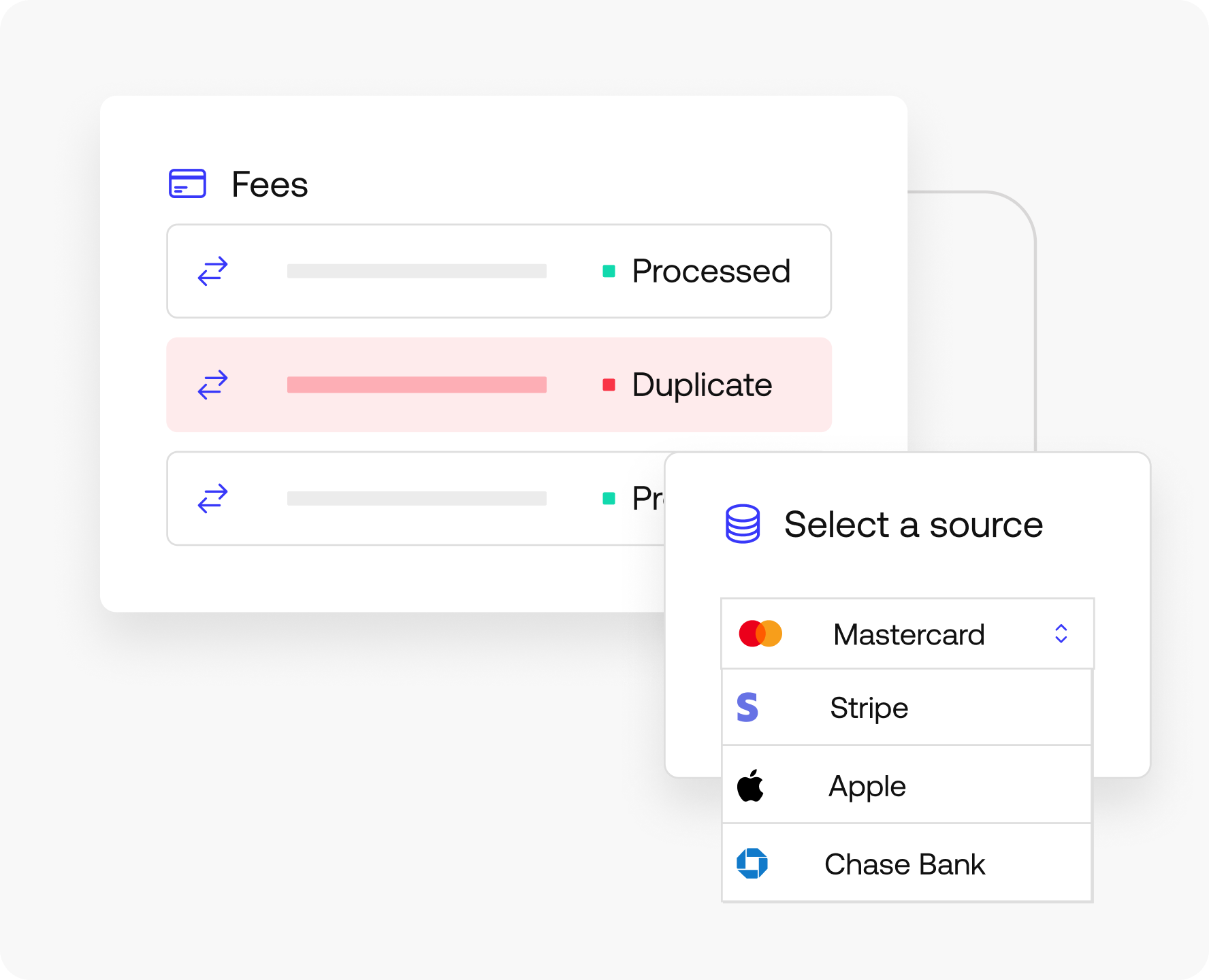

Accelerate reconciliation across six key functions, with more than 60 controls that minimize errors and drive tangible ROI.

Reconcile authorized requests/responses with network data and match clearing files to issuer records, avoiding mismatched approvals or unauthorized postings.

Reconcile scheme fees, interchange, and network adjustments against issuer/acquirer records, checking daily summaries for completeness.

Validate funds debited from issuers and match pre-arbitration/arbitration cases, confirming accepted items are scheduled with reversals.

Calculate daily net settlements and validate receipts against bank statements, checking scheduled settlement positions.

Partition domestic and international agendas and confirm financial movement of funds matches expected positions.

Validate programmed vs. received bank receipts, investigating differences like delays or partials.

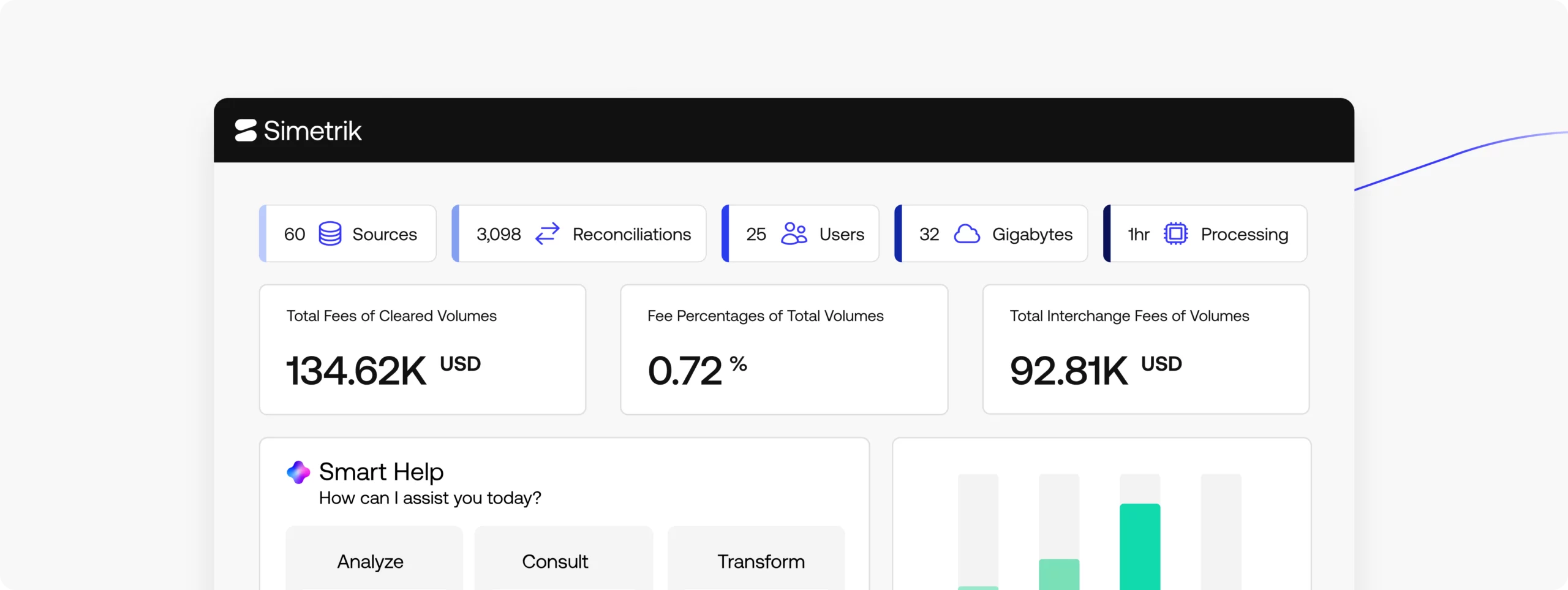

Simetrik’s preconfigured, proven solutions help you automate reconciliation and realize ROI faster.

Simetrik comes with pre-built dashboards with over 20 KPIs, with AI-powered insights and recommended actions that drive ROI up by as much as 10 bps.

Go live in just a few weeks with modular, ready-to-use capabilities and guided implementation. Simetrik’s setup assistant connects your data, validates mappings, and surfaces mismatches early.