Watch now: Discover how a leading PSP operating in 12 countries automated hundreds of reconciliation workflows

Solutions

Use Cases

Watch now: Discover how a leading PSP operating in 12 countries automated hundreds of reconciliation workflows

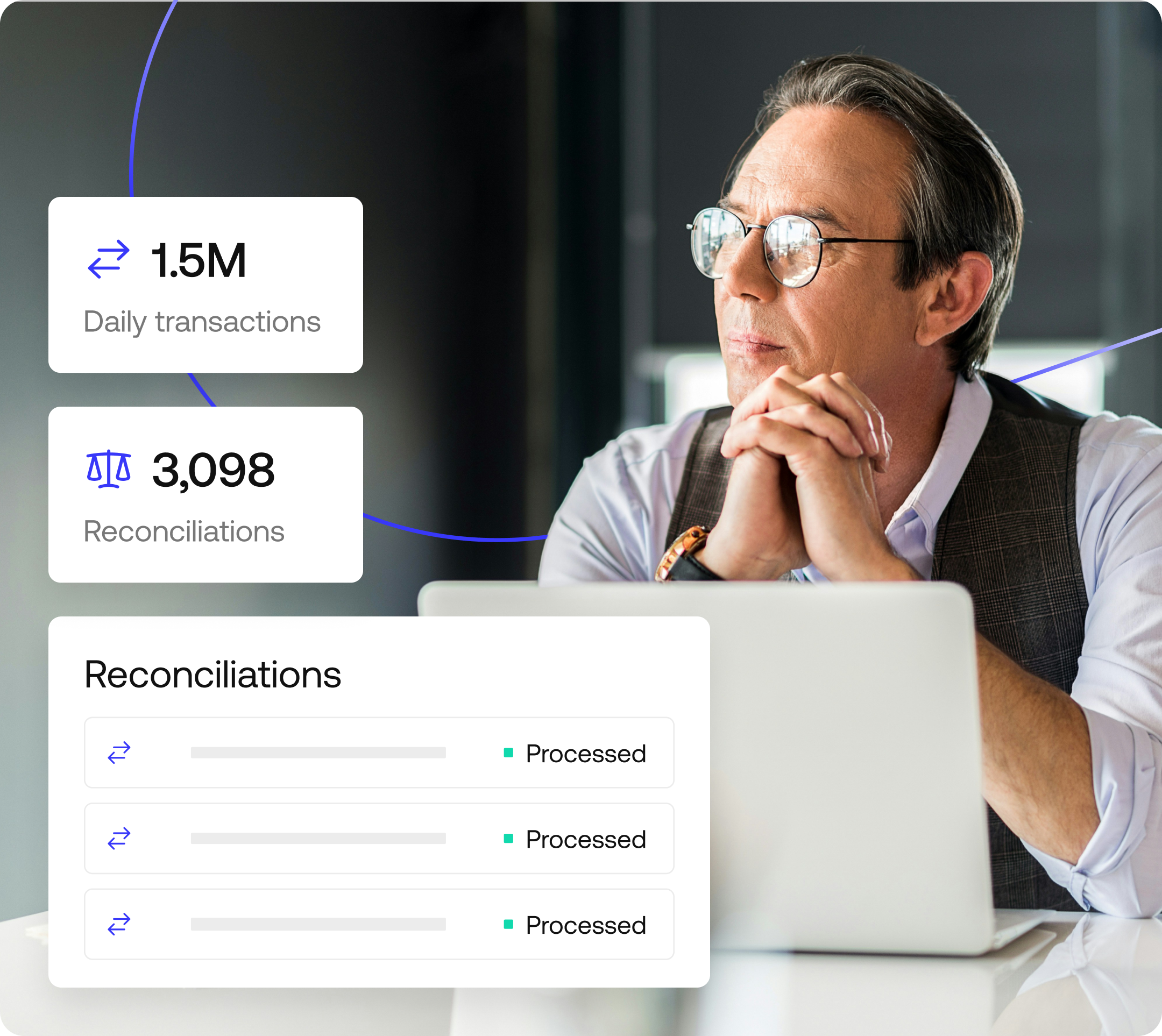

Automatically reconcile millions of cross-border microtransactions a day, adding a new layer of control and transparency to your finance operations.

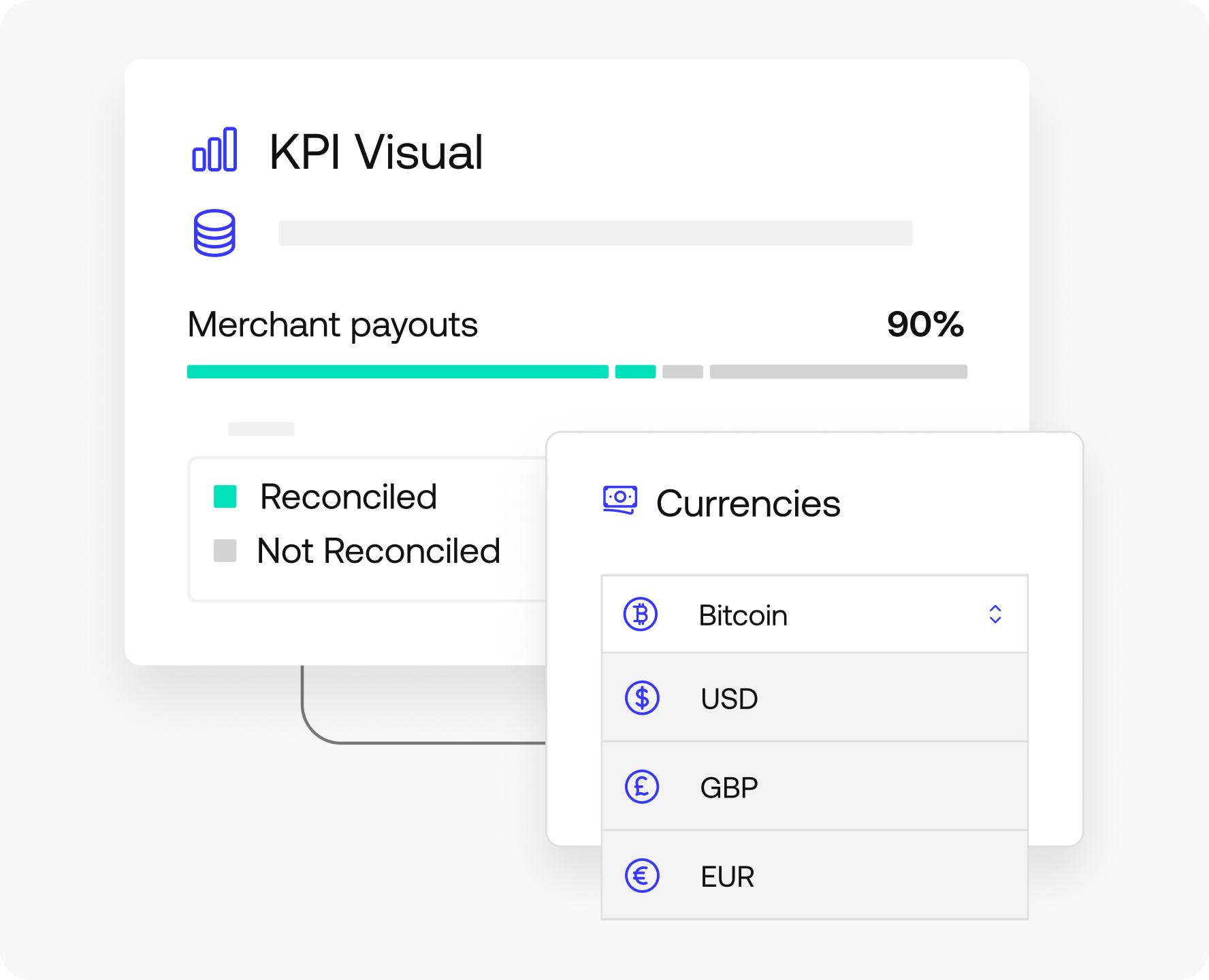

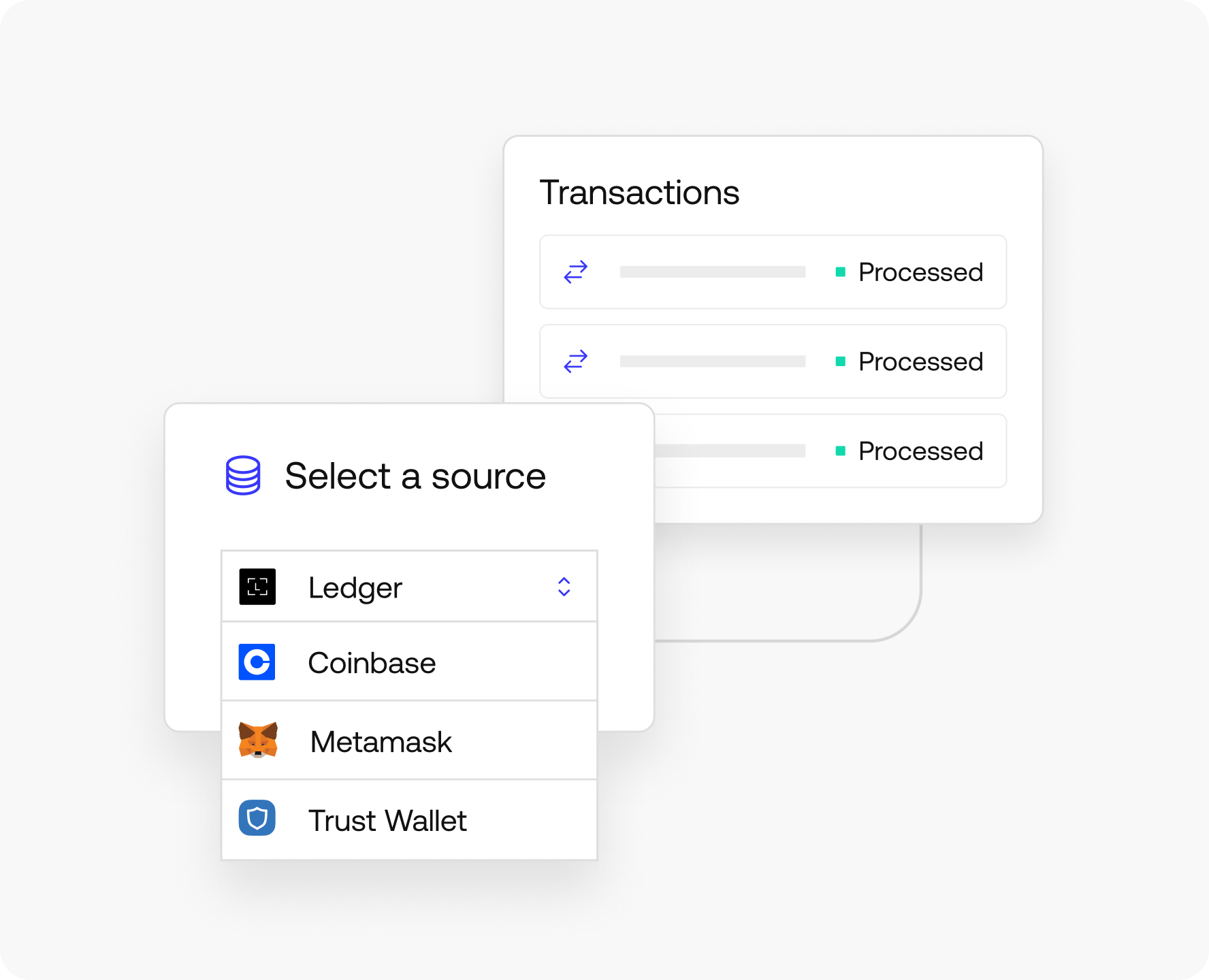

Standardize and reconcile transactions across blockchain networks, custodians, trading platforms, and internal ledgers.

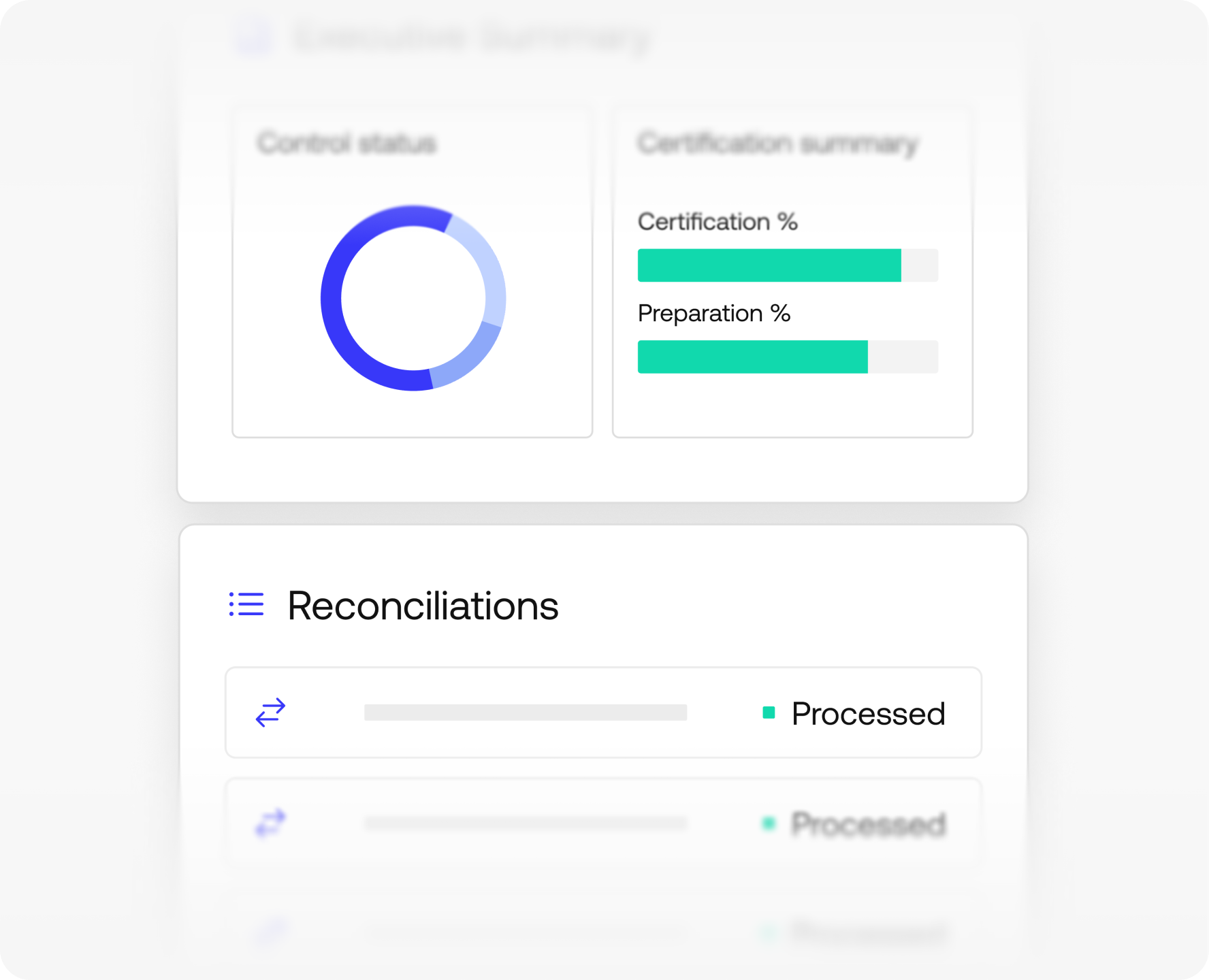

Apply scalable governance and compliance workflows with Simetrik’s agentic reporting capabilities.

Build trust and loyalty with customers as you expand into new products and markets—all without the heavy engineering costs.

Address mismatches and discrepancies with streamlined exception management and real-time alerts.