Watch now: Discover how a leading PSP operating in 12 countries automated hundreds of reconciliation workflows

Solutions

Use Cases

Watch now: Discover how a leading PSP operating in 12 countries automated hundreds of reconciliation workflows

Win back hours a day spent matching transactions, correcting errors, and updating operational balances. Simetrik lets you focus on exceptions while the platform does the rest.

Minimize risk and cost from reconciliation errors, fraud, overpayment, and unnecessary fees.

Reduce leakage, support expansion and AI innovation, and adapt quickly as you scale.

Meet regulatory and internal compliance requirements with fully traceable, automated reporting.

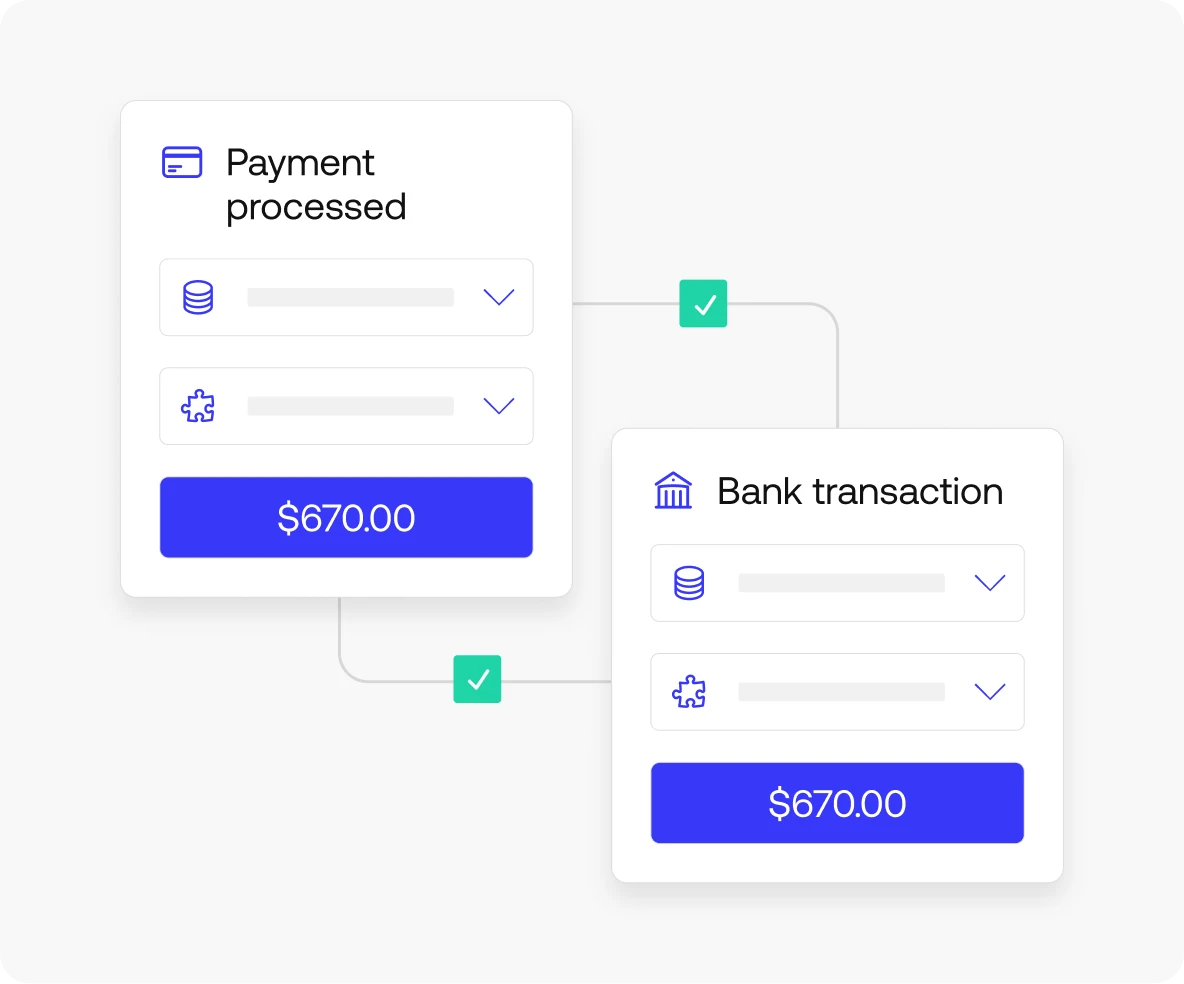

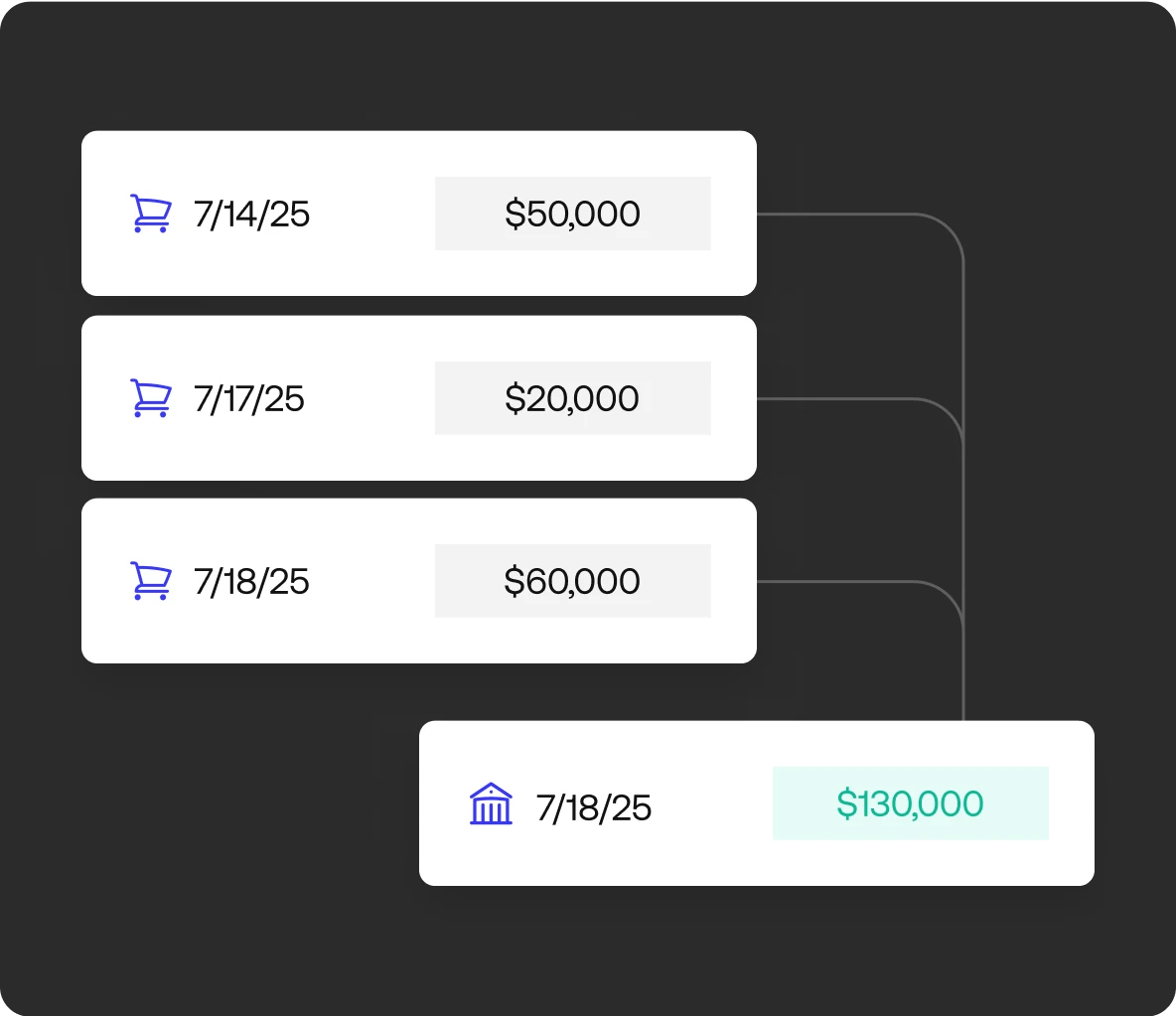

Instantly match and validate millions of transactions a day, reconciling them against cash balances, receivables, forecasted revenue, and more. Simetrik standardizes data from any source and applies configurable AI logic to catch discrepancies.

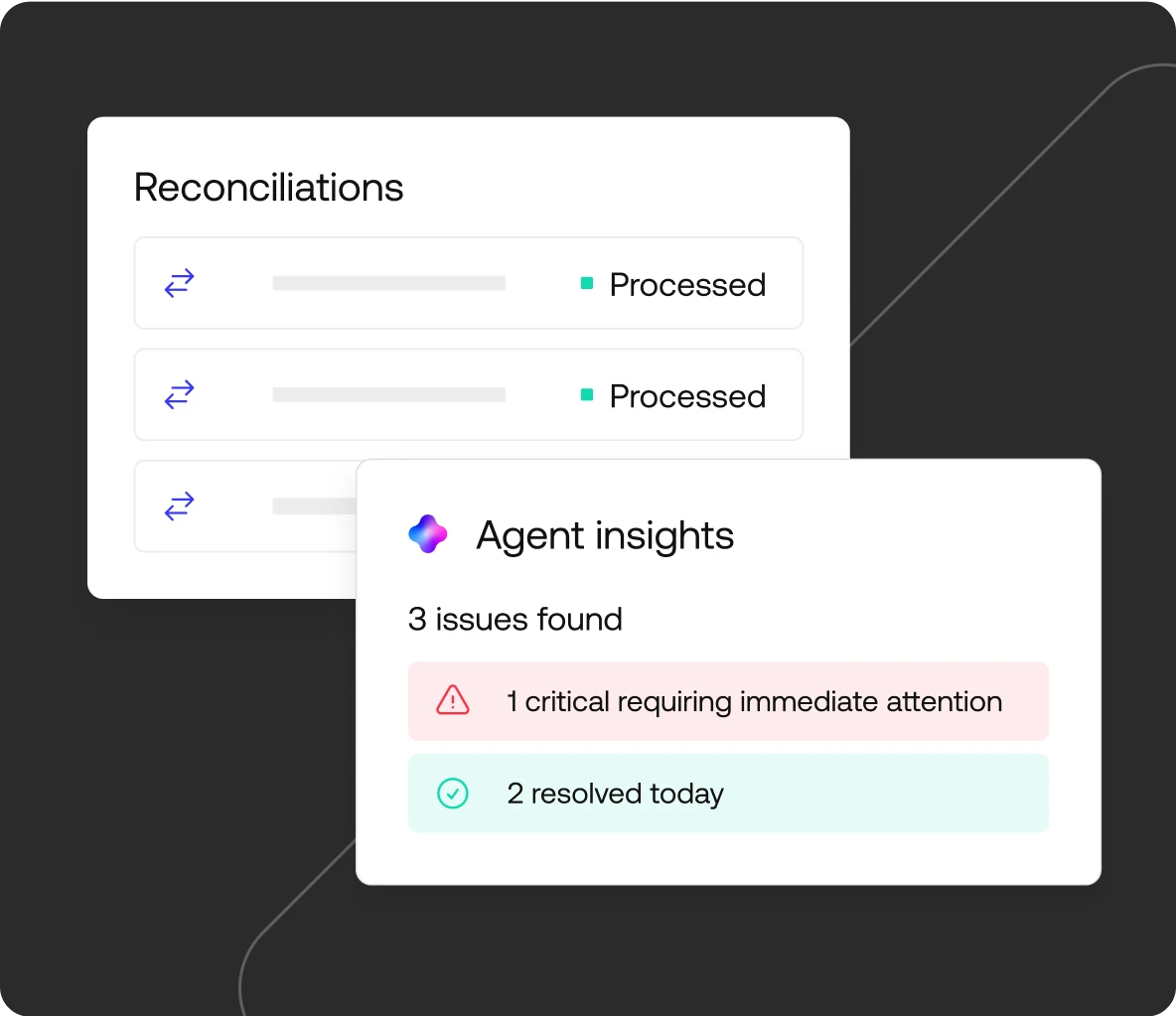

Speed up your financial close by streamlining complex reconciliation workflows. Leverage preconfigured solutions, AI-generated reports, and built-in AI agents to reduce your close cycles by as much as a week.

Send granular, transaction-level data to financial risk models and analytics platforms to uncover suspicious activity that legacy solutions can’t pinpoint in time.

Provide complete visibility into transaction-level data. Securely send logs with auditors, pipe reconciled data into forecasting models, and share tailored dashboards with your stakeholders.

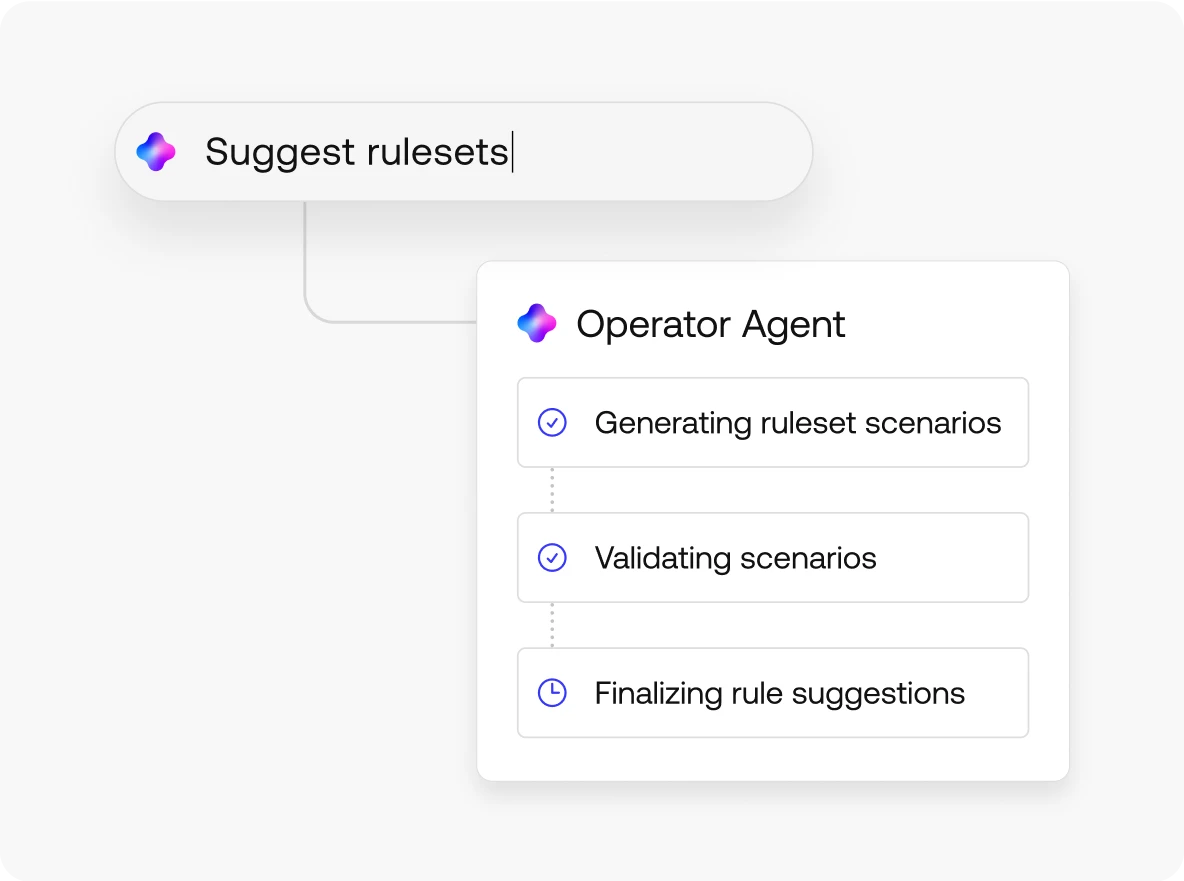

Configure global reconciliation logic, apply nuanced permissions, and enforce policies with the help of AI agents. Simetrik makes it easy to manage complex finance operations without the engineering burden.