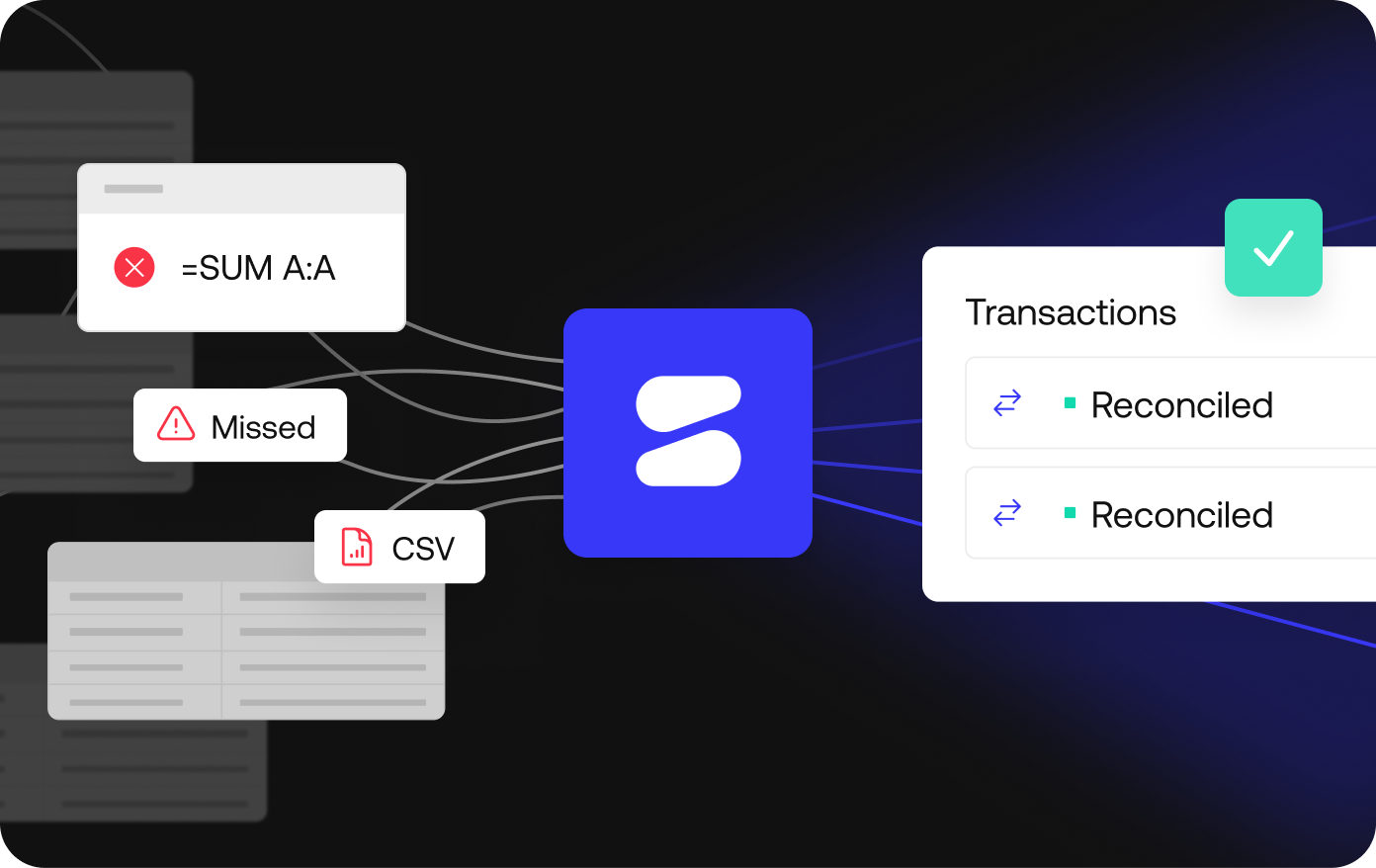

When companies scale quickly, the first cracks often appear in back-office processes. Reconciliation is usually the most visible and the most painful. Teams start each morning inside spreadsheets, pulling CSVs from processors, painstakingly matching transactions, and hoping the numbers line up. But while manual workarounds might be sufficient at a small scale, they quickly turn into structural risk as volumes explode and partners multiply.

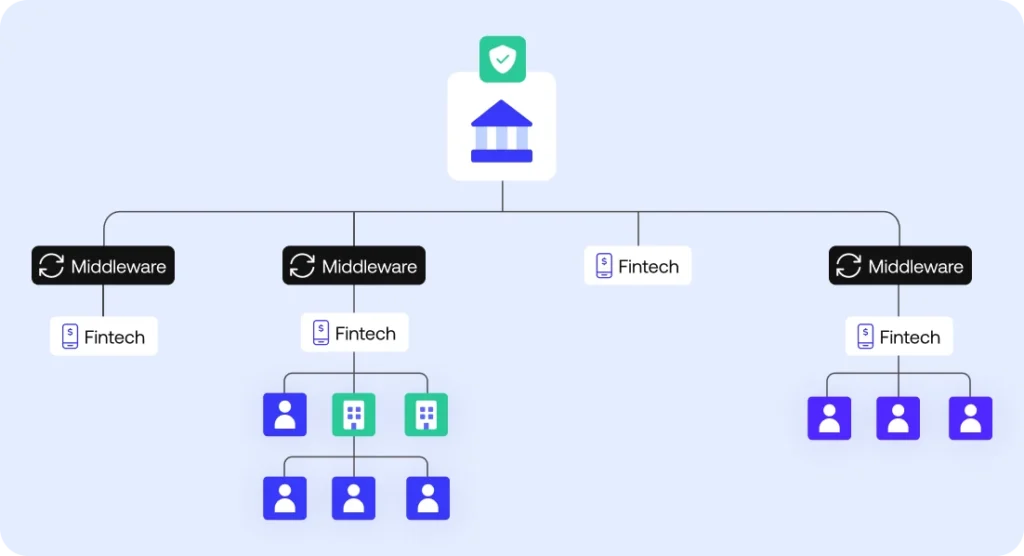

This is a familiar story: multiple bank and processor accounts, dozens of payment stakeholders, hundreds of thousands of daily entries, and activity spread across many time zones all contribute to a level of complexity that’s hard to reign in.

At scale, reconciliation must work for everyone. Finance leadership needs speed and reliability, operations wants transparency and control, and everyone is asking for a single source of truth. In this post, we break down the real problems behind manual reconciliation and how an automation-first approach with Simetrik turns daily firefighting into a durable operating model.

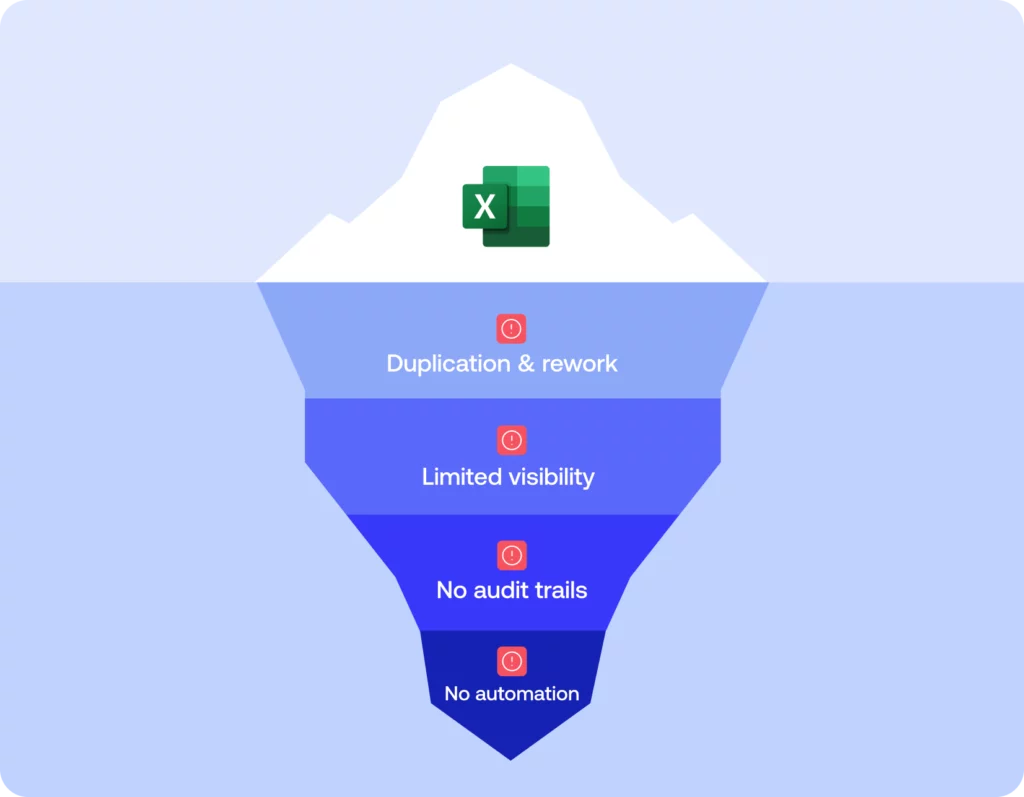

The cost of spreadsheet-driven reconciliation

Spreadsheets are flexible and fast at the start. At scale, however, they create hidden costs that compound daily.

Instead of a single, cohesive view of transactions and financial data, spreadsheets only offer a disparate snapshot of the numbers at any given point in time. There’s no way to accurately pinpoint what’s reconciled, what’s pending, or where risk is concentrated across the organization. Context lives in people’s heads and scattered tabs, not in a scalable system.

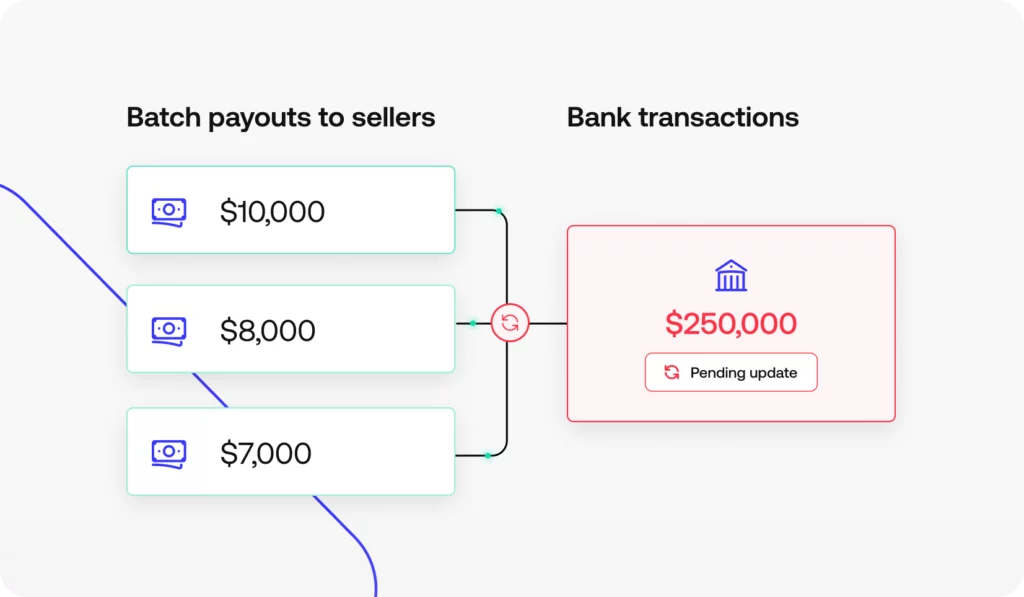

Take this recent story: The Federal Reserve Board and the FDIC imposed a total of $250 million in civil penalties on Discover Financial Services for overcharging merchants on interchange fees and failing to tell them. That’s on top of the $1.2 billion they already agreed to settle a class action lawsuit over card misclassification.

Could this all have been remedied by better recordkeeping? Maybe. When things go wrong, you don’t want to present outdated, untraceable spreadsheets or messy legacy system files to your auditors. Using an industrial-strength, proven system is a much better way to face off with a regulator in any region.

The cost of spreadsheet-driven reconciliation is due to several factors:

- Duplication and rework that wastes hours and adds risk

- Limited visibility that stunts leadership’s ability to make decisions

- Lack of clear, immutable audit trails needed for compliance

- Lack of automation, with experience analysts reduced to data movers

These are not simply inconveniences. They are control failures waiting to surface. And the higher the transaction volumes, the worse these failures will be.

Why volume breaks spreadsheets and how to fix it

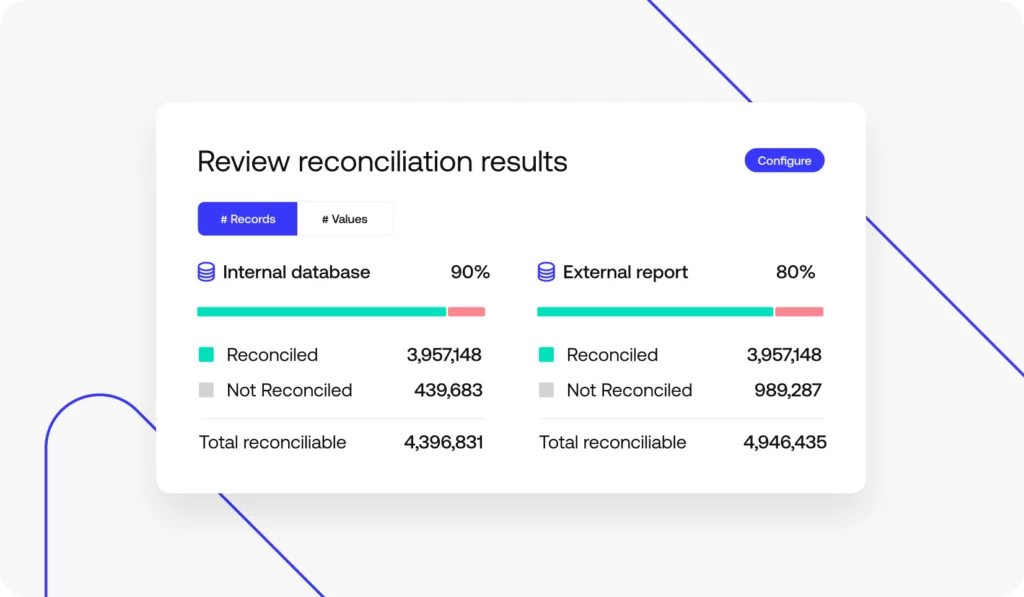

The largest PSPs and marketplaces process millions of transactions a day. At that scale, two things matter most. First, you must reconcile at the transaction level, not only by balance. Second, you must do it without forcing humans to wait on a screen.

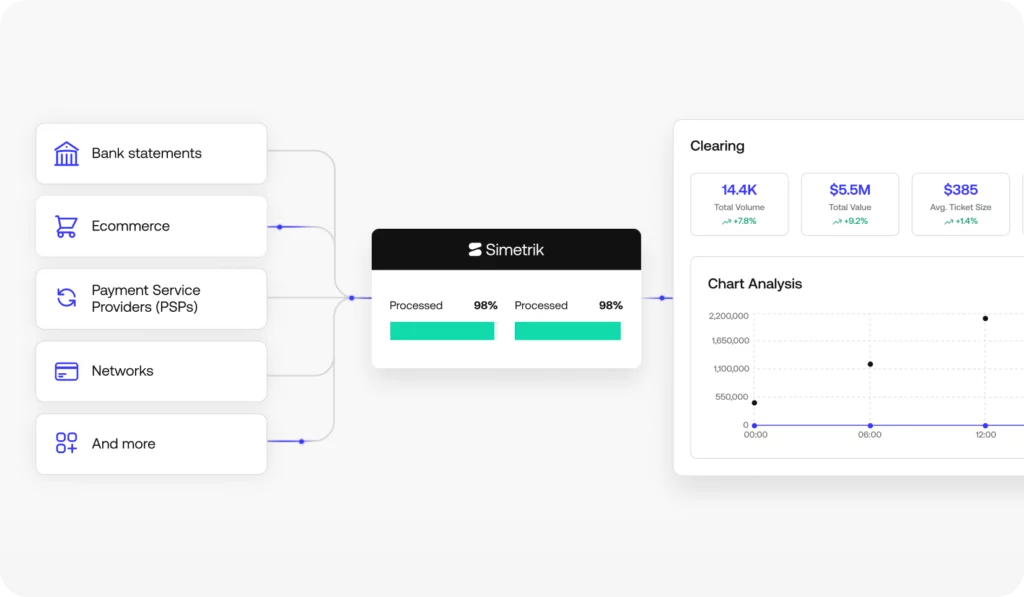

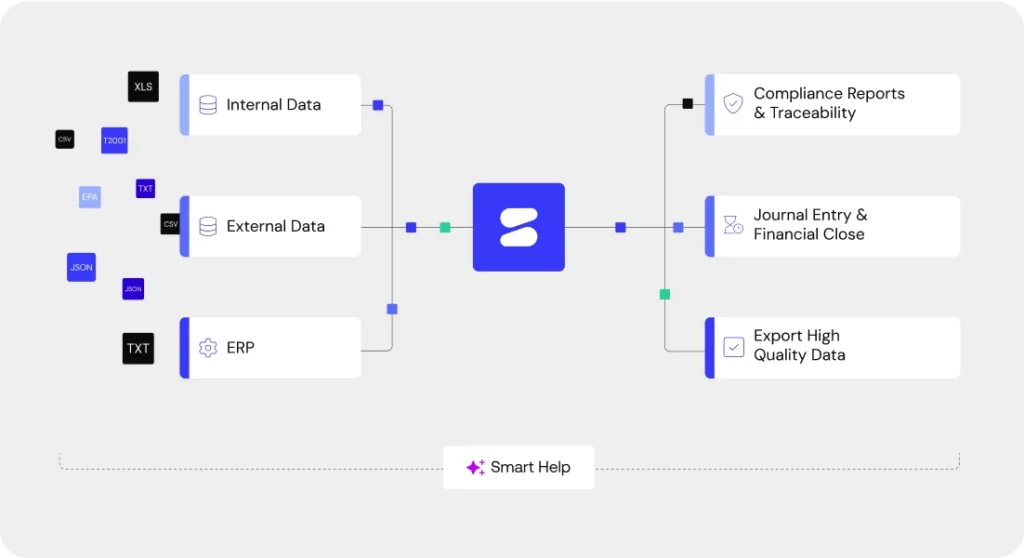

To accomplish this, you need a system that ingests data from processors, banks, and internal systems in parallel, normalizing heterogeneous files and APIs into a standard schema. When the massive burden of data management is automated, analysts can focus on the tasks that need manual attention, working from a live queue of exceptions rather than full datasets.

The outcome is far greater efficiency. Opens get cleared the same day. Aged items shrink and stay visible. No one builds intermediate spreadsheets to make the tools work. Performance is constant whether you process ten thousand or ten million rows.

Modern reconciliation platforms like Simetrik were built to usher in this change.

What modern reconciliation should deliver by default

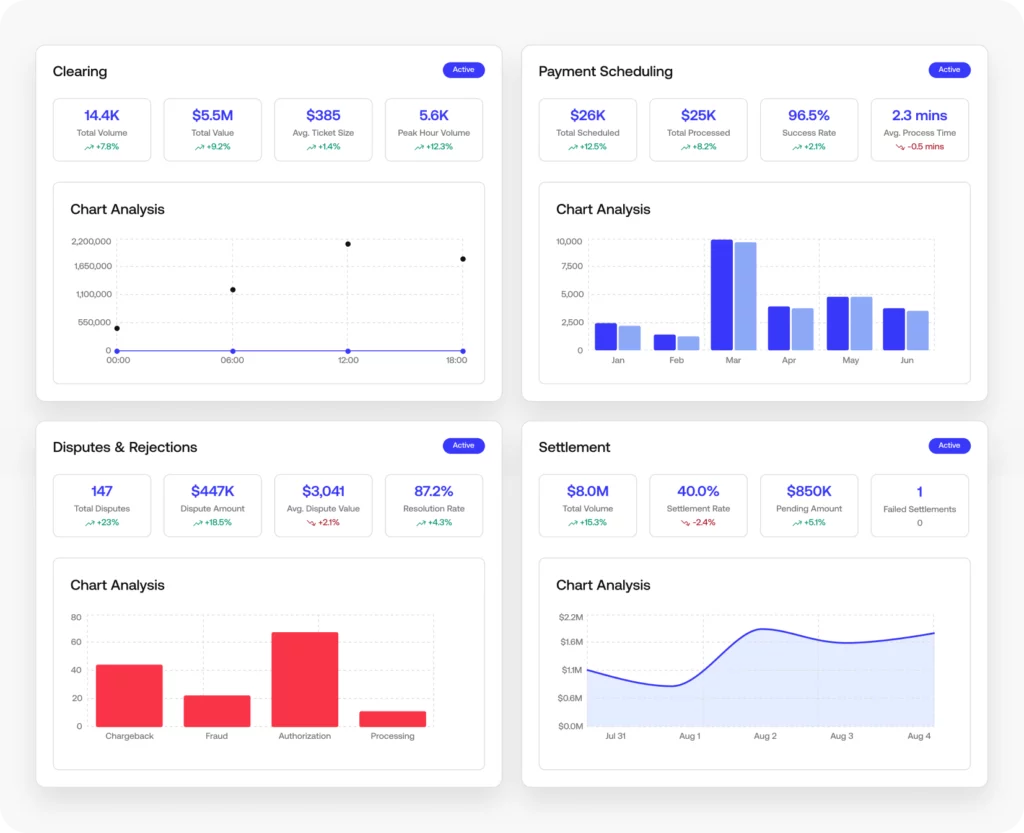

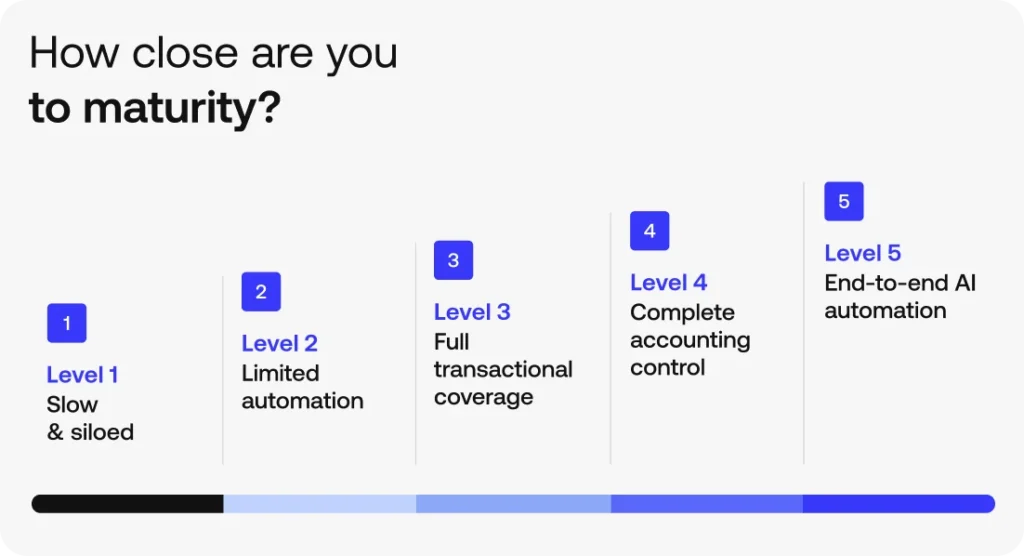

A modern reconciliation platform improves visibility, efficiency, and traceability by providing end-to-end financial control, from transaction record ingestion to compliant reporting.

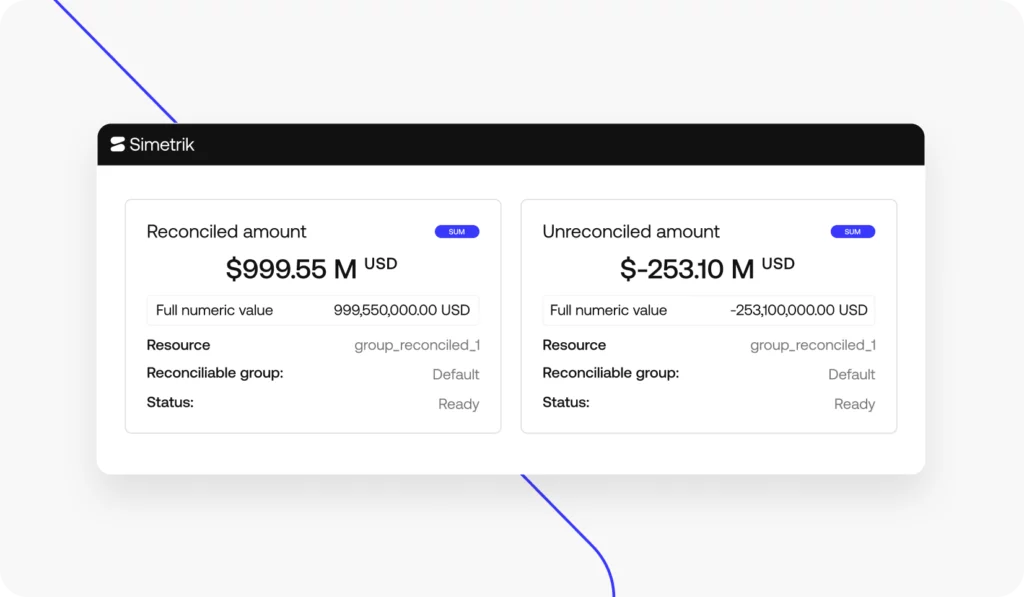

In practice, it’s one place to see everything related to finance operations and money movement. All accounts, partners, and processors are in a unified dashboard with real-time status on transactions processed, fees charged and incurred, what’s cleared vs. outstanding, and dozens of other metrics that matter to the office of the CFO.

The only way to consolidate and validate this kind of data at enterprise scale is by using AI-driven, intelligent matching and reconciliation logic to automate the work that spreadsheets and workarounds can’t – all while giving the finance team complete control.

When considering a modern reconciliation platform, check for these critical features:

- AI-driven matching. Configurable rules and logic that automatically ingest, normalize, and enrich transaction data with disparate formats, currencies, and fields.

- Enterprise-grade infrastructure. Elastic compute so performance scales with volume without slowing analysts down.

- Granular access control. Configurable profiles that give reconcilers, engineers, finance leaders, and other stakeholders the level of access and visibility they need. Every action is permissioned and recorded for audit trails.

- Collaboration across teams. Customer support and payments operations can view and update the status of items that need their action, no forwarding spreadsheets required. Context and conversation stay attached to the underlying transaction.

- A real audit trail. Immutable logs of every match, change, note, and approval, with timestamps and user attribution. Evidence is built into the workflow, not recreated later.

- Automated close workflows. Roll-ups for fees, failed payments, chargebacks, and more without the scramble. Audit ready, compliant reports configured to relevant standards.

These features not only reduce risk and cost by streamlining reconciliation, they allow you to get new financial products to market faster while still guaranteeing security, traceability, and profitability.

How Simetrik aligns with your operational reality

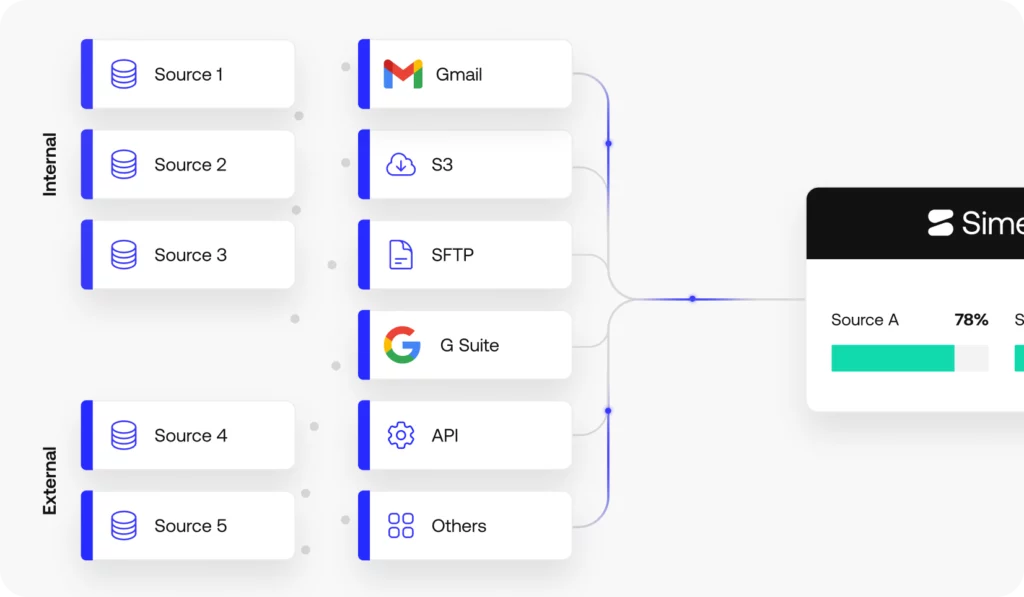

Simetrik is an AI reconciliation platform that’s designed to solve your real-world challenges in scaling finance operations. It automates and streamlines the reconciliation process from beginning to end, starting with enterprise-grade data ingestion and management and ending with advanced workflows powered by your reconciled data.

The use cases for Simetrik are nearly limitless – our customers use real-time, transaction-level data to power forecasting and risk models, automate collections and customer outreach, and shore up losses due to miscalculations in the reconciliation process. But they all have one thing in common: they can move faster and smarter without giving up control.

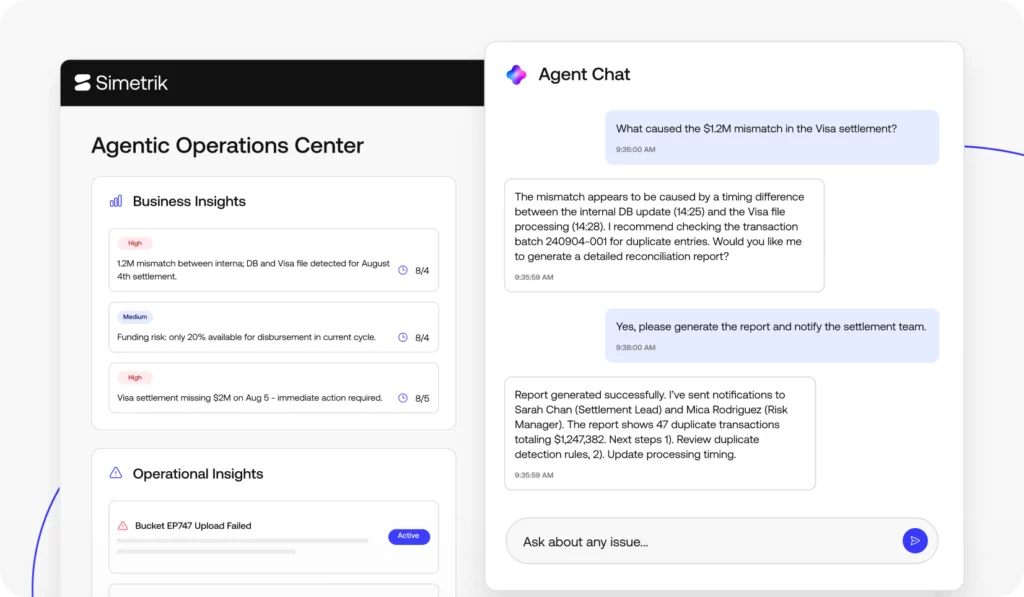

From data movers to investigators

By adopting an AI reconciliation platform, you allow analysts to take on a more impactful, strategic role. They can see discrepancies and exceptions in their dashboard, along with all the context they need to investigate and resolve the issue.

With Simetrik, exceptions arrive enriched with the fields that help you act. Counterparty, flow type, currency, amounts, references, prior attempts, and related items are presented together. Ownership is assigned automatically based on rules. Notifications bring in the right teammate from support or payments when their input is needed.

Analysts spend their day resolving, not assembling. They close items, add root cause codes, and propose rule changes when patterns emerge. Managers see throughput, backlog age, and the value at risk by team and partner. Leadership gets a clear view of operational health and financial exposure, not a stack of spreadsheets.

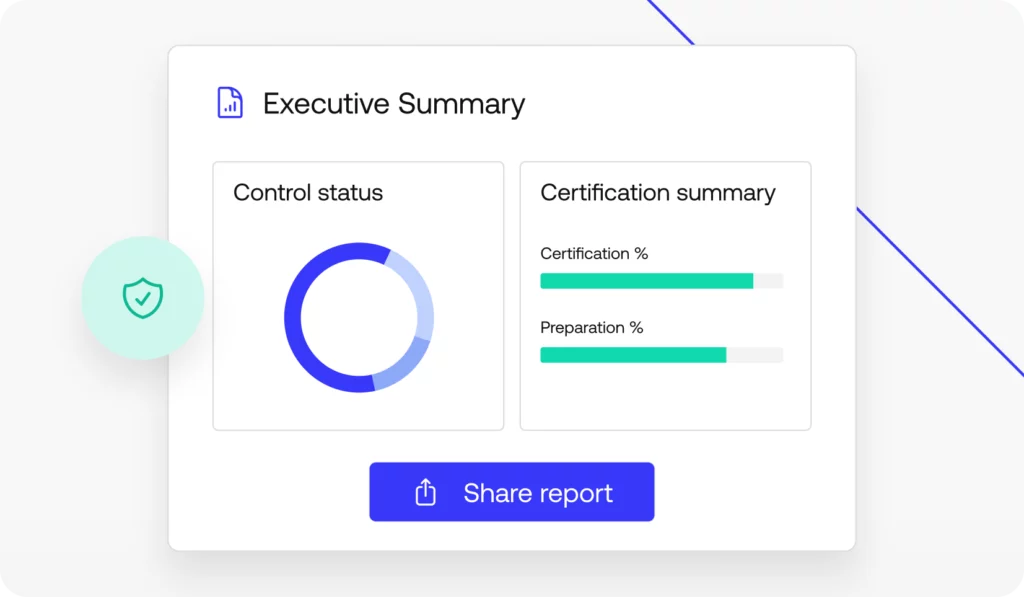

Reporting that’s ready to share and act on

Most teams still struggle with reporting at the end of a period. Lack of traceability, manual data collection, and missing information all make it difficult to close fast without errors.

Regulatory requirements and internal protocols add complexity to reporting, too. Documentation must meet the requirements of each organization, region, and regulatory body, often adding days of prep onto an otherwise-finished close process.

Simetrik turns commonly required information and recurring questions into easily accessible answers. When users ask Simetrik’s AI agent questions like, “Which partners drive most exceptions this quarter?” or “Which accounts are consistently closing late?”, they’re saved for future use in reporting. The platform also generates compliant documentation for the standards and reporting requirements most relevant to your business.

These reports are always on and drillable to the underlying transactions. Finance doesn’t wait for operations to compile data. Operations doesn’t rebuild the same pivot table for the tenth time.

Integrations that keep systems aligned

Fast-growing companies often implement accounting systems on a separate track from operations. Reconciliation then becomes a bridge between external movement and internal books. That bridge needs to be stable.

Simetrik connects to banks, processors, ledgers, and data warehouses. It publishes cleared positions and exception summaries downstream. It ingests reference data upstream so matching rules reflect reality. If you are still in the process of standing up an ERP, Simetrik can export structured files that slot into your current process immediately. When you are ready for deeper integration, you already have consistent data and a clean audit trail.

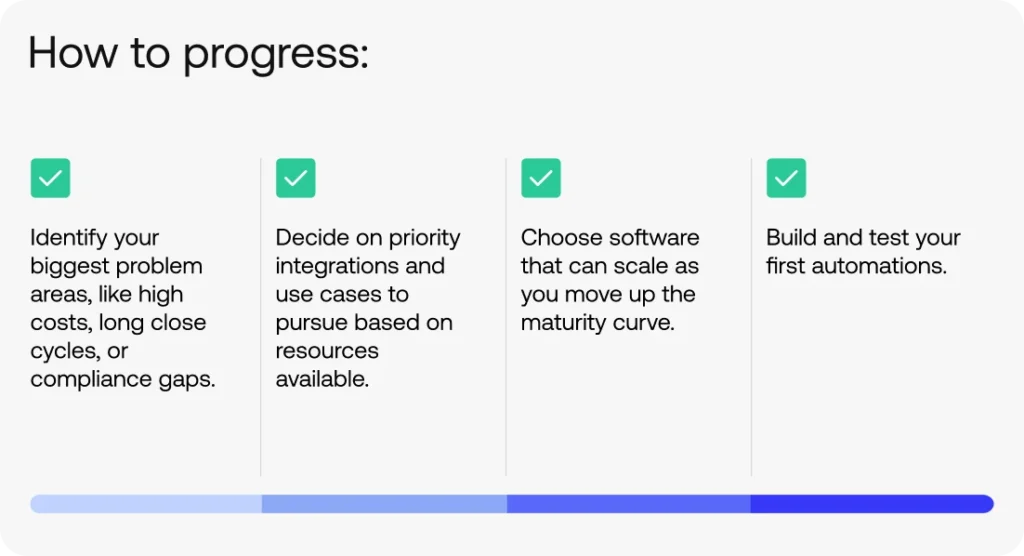

What the first 90 days look like

Teams often ask how to move from today’s spreadsheet reality to a controlled operating model without losing momentum. At Simetrik, we’ve designed a path that’s straightforward and optimized for your success.

- Week 1-4: Connect the highest volume processors and bank accounts. Mirror today’s matching logic inside Simetrik. Start clearing exceptions in the platform while keeping spreadsheets as a shadow for comfort. Deliver the first executive dashboard that shows completion and aged items.

- Week 5-8: Retire spreadsheet workflows for in-scope accounts. Add rule stages that reduce manual touches. Turn on ownership routing and notifications. Introduce notes and reason codes for learning. Publish monthly reports directly from the platform.

- Week 9-12: Expand coverage to remaining accounts and partners. Tighten access profiles. Enable maker checker on sensitive actions. Integrate with your downstream systems or automate file exports. Conduct the first month-end close entirely from Simetrik with a postmortem on remaining gaps.

This approach keeps risk low and momentum high. Value lands in the first month, and confidence grows as exceptions shrink and reporting becomes self-service.

Finding ROI: seeing fast outcomes on Simetrik

Moving to Simetrik leads to tangible and repeatable results in as little as a few weeks. The larger your scale, the more impact you’ll see – the platform finally consolidates data and workflows across many global partners, disparate files and formats, and your own distributed processes.

Here’s what Simetrik customers see once they deploy:

- Faster cycle times. Most exceptions are resolved on the same day, with no month-end redo because the system reconciles continuously.

- Smaller backlogs. Aged breaks are visible, prioritized, and owned. Items don’t get lost because a row was not copied forward.

- Increased capacity. Analysts spend their time investigating and fixing root causes. Teams can handle higher volumes without adding headcount at the same rate.

- Improved visibility. Leaders see risk by value and by age, broken down by partner and flow. Finance closes with confidence because exceptions and adjustments are traceable.

- Stronger control. Every action is logged, rule change versioned, and approval flow enforced. Audits become a walkthrough, not a reconstruction.

You need a platform that is powerful yet easy to adopt, respects roles and keeps people accountable, and generates the reporting finance needs without creating new work for operations.

Simetrik is built for exactly this environment. We combine robust data ingestion, flexible matching, granular access, and rich auditability in one product, transforming reconciliation from a spreadsheet nightmare into an operational strength that scales with you. Request a demo of Simetrik here and see how easy it is to adopt AI reconciliation.